by Sam Franklin | September 14, 2022 | 13 min read

An actionable guide to calculating and improving your revenue growth

Get fundedLast updated: October 06, 2022

Revenue growth is one of the most important metrics for any business. Although it’s pretty easy to calculate your company’s revenue growth in a certain period, you need to understand how it works and what aspects of the business are contributing positively or negatively to it.

This article looks at how to calculate revenue growth, revenue growth management, and much more. Keep reading to learn how to increase your revenue growth.

Table of contents

- What is revenue growth?

- Why is revenue growth important?

- How to calculate revenue growth

- What is revenue growth rate?

- Revenue growth as a strategy

- Things to consider when looking at revenue growth

- Common revenue growth stages

- How revenue growth is different for subscription businesses

- Best revenue growth strategies

- How to get growth capital for a young business

- Revenue growth FAQs

What is revenue growth?

A simple definition of revenue growth is an increase in revenue over a specific period. It is often represented as a percentage and shows how a company’s revenue increased in one period compared to a similar previous period.

Most investors calculate revenue growth year over year (YoY) or quarter over quarter (QoQ). The former means the annual revenue compared to the previous year, while the latter is the quarterly revenue compared to the previous quarter.

It’s important to note that revenue is often confused with earnings and sales, so let us look at their main differences:

Sales - The amount of money a business makes from selling products and services. This figure doesn’t factor in expenses.

Revenue - The total amount of money a business makes from all its sources, including sales, royalties, investments, fees, etc. Revenue doesn’t factor in expenses.

Earnings: To calculate earnings, expenses are deducted from the total revenue.

Another major difference is that sales and earnings are often goal-oriented, while revenue growth is more of a strategy than an end goal.

Why is revenue growth important?

For early startups, revenue growth is an essential method of tracking the business’s progress. Revenue growth rate helps these businesses measure comparative progress (month over month) instead of relying on current revenue, which can be pretty misleading on its own.

These metrics are not only helpful to the founders but also to the investors who’d like to evaluate the current and potential growth of the business.

A company that experiences high revenue growth rates is also likely to have a high return on investment. A good example would be Nvidia which grew from $10.918M of annual revenue in the fiscal year 2019 to $16.675M in the fiscal year 2020, a 52.73% revenue growth.

However, the month-over-month revenue growth can be misleading for startups. Early-stage startups are likely to experience exponential growth for the first few months. The mistaken perception is that the revenue growth will remain the same as the business grows, while in reality, the growth often decreases when the business matures.

How to calculate revenue growth

Revenue growth is calculated by comparing the previous period’s revenue with the current period's revenue. Each period you are comparing should be of equal length, so you can’t compare this month to the last quarter.

The revenue growth formula

To calculate the revenue growth, you subtract the previous period's revenue from the current period's revenue, then divide the result by the previous period’s revenue. You can then convert this into a percentage by multiplying it by 100.

Here’s the basic formula:

Revenue Growth = ((Current period revenue - previous period revenue) / previous period revenue) ✕ 100

For instance, if your company’s revenue doubles to $200,000 from $100,000 in a similar period last year, it has experienced 100% revenue growth.

Here’s how you arrive at that figure:

(($200000 - $100000) / 100000) ✕ 100 = 100%

What is revenue growth rate?

Revenue growth rate is the speed at which the income from sales or services is increasing. It is quite similar to Compound Annual Growth Rate (CAGR), and the terms are often interchangeable.

The revenue growth rate can incorporate more years and give a clearer picture of the company’s financial direction.

For instance, Nvidia - the company from the previous example - had a growth rate of 27.91% between the fiscal years 2015 and 2020.

How to calculate revenue growth rate

To calculate the revenue growth rate, you only need three variables: the current period revenue, the initial period revenue, and the compounding period (analysis period).

As we established above, the revenue growth rate can incorporate more than one year. Therefore, the revenue growth rate formula is:

Revenue growth rate = (( current period revenue / initial period revenue ) 1/n-1) ✕ 100

Where:

n - number of periods

Using Nvidia as an example, we can calculate the revenue growth rate from the fiscal year 2015 to 2020 as follows:

Revenue growth rate = ((2020 revenue / 2015 revenue)1/5 -1) ✕ 100

Therefore:

Revenue growth rate = ((16.675M / 5.01M)1/5 -1) ✕ 100

Revenue growth rate = 27.29%

How to project revenue growth rate

By using the revenue growth rate, it is possible to project the expected growth rate for a future period. While this is purely speculation, it helps companies predict the direction of their businesses and prepare for the anticipated growth.

We can estimate future revenue using the following formula:

Revenue growth rate = ((Final period revenue / current period revenue) 1/n -1) ✕ 100

In other words, we use the revenue growth rate formula, but replace the initial period revenue with the current period revenue, then replace that with the final period revenue. Using Nvidia’s growth rate as an example, we can project the company’s revenue in 2023:

Revenue growth rate = (( 2023 revenue / 2020 revenue) 1/3-1) ✕ 100

27.29% = (( 2023 revenue / 16.675M) 1/3-1) ✕ 100

2023 revenue = $34.310M

Revenue growth as a strategy

Revenue growth strategies are plans to grow a company’s revenue both in the short term and long term. Since each company is different, the revenue growth strategies will also vary.

That said, any good revenue growth strategy ensures your sales, marketing, and customer service departments are communicating and working together in synergy. One of the best ways to achieve this is by ensuring all employees are satisfied with their jobs and involving them in the planning process.

Using an all-inclusive communication platform is also important to help the information flow smoothly between the departments.

Why you should focus on revenue growth instead of other types of growth

A revenue growth analysis gives you a broader picture of how the business is doing: what is working and what is dragging it behind. With this information, you can narrow down the key problems and fix them.

A revenue growth formula should assist in developing strategies in other areas, including:

Human resources

Pricing

Marketing

Customer acquisition and retention

Sales

Professional development

If your revenue growth isn’t meeting your expectations, you can review the strategies of these areas and narrow down the exact pain points.

Most businesses are tempted to focus on earnings growth over revenue growth. While you should evaluate both, it’s important not to dwell on earnings growth. This is because to get earnings, we subtract costs from revenue.

Therefore, it’s possible to boost earnings by cutting costs. But, without a concrete revenue growth formula, this is a temporary solution.

Simply put, focusing on your revenue growth rate gives you a holistic idea of your company’s health. This makes it easier to identify problems, fix them, and continue growing your revenue.

Things to consider when looking at revenue growth

Analysing your revenue growth does not just mean thinking about how to increase your revenue. It also requires you to review your company’s financial statements and determine which aspects of your business are causing revenue decline and which are responsible for revenue growth.

Are you achieving your long-term goals at this rate?

As you analyse your revenue growth, it’s important to check if you’re still on track to achieving your long-term goals. However, don’t panic if you’re not hitting long-term goals at your current rate. Instead, create a new revenue growth strategy to get you back on track.

You can start with your existing customers by increasing your Average Revenue Per User (ARPU). Common ways of achieving this include exploring value-based pricing, encouraging more usage, and more aggressive upselling techniques.

If your business offers subscription services, focus on keeping existing customers who pay recurring subscriptions instead of signing up new customers.

Common revenue growth stages

While it’s called ‘revenue growth,’ sometimes your revenue might stagnate or even dip. Every business should anticipate going through several stages, and the revenue growth rates are different in each:

Startup

At this stage, the business is very young, and you are still figuring things out. There’s probably a funding problem or issues with the other aspects of the business, such as marketing and human resources.

Most businesses don’t experience revenue growth at the startup stage and unfortunately, some of them close down. One of the best ways to keep an early startup afloat is to get third-party support.

Growth

At the growth stage, your business is mature enough to have a good business plan. It has also had enough time to focus on things beyond internal struggles.

However, the revenue might be stagnant or even dip, as you need to find investment capital.

Maturity

If your business survives through the growth stage, it gets to the maturity stage. Here, you’ve learned from the mistakes of the two previous stages and mastered all aspects of the business.

It’s easy to feel secure with your revenue growth strategy at this point because the business is somewhat predictable. The revenue is likely to grow at steady rates, probably increasing by 5% per fiscal year.

Renewal/Decline

This stage can come out of the blues. While revenue increases and decreases in every business, if your revenue declines steadily for three consecutive quarters, the problem probably began years ago. If you don’t take drastic action, your business might be in trouble.

How revenue growth is different for subscription businesses

Since subscription businesses rely on winning and maintaining recurring revenue, they need to factor in churn (the rate at which customers cancel their recurring subscriptions) to understand their revenue growth.

Unfortunately, most SaaS businesses focus on their revenue growth rate and use it to gauge their business growth. However, this logic is not ideal for most SaaS companies.

Even if a subscription business experiences constant revenue growth from subscriptions, it will eventually fail if it also has high churn rates. This is because although it is signing up new customers, it is also losing a considerable amount. In the end, these businesses depend on two revenue streams: signing up new customers and income from recurring subscriptions.

It’s, therefore, important for subscription businesses to monitor churn rates as they make a revenue growth strategy.

Best revenue growth strategies

It might take a couple of years for a startup to achieve consistent revenue growth. It’s, therefore, important to keep an eye on your revenue, fix problems, and be willing to learn for your business to grow.

As a result, you should view small year-over-year or quarter-over-quarter revenue dips as opportunities instead of negatives. Use them to strategise and increase your revenue growth.

A revenue growth strategy should be a proactive, rather than a reactive, measure. If you wait until there’s a problem to react, you might have to resort to cost-cutting measures, which could hurt your employees, customers, or even investors.

While the general revenue growth strategy is to ensure all teams are working together, there are more specific measures you can take.

Find innovative ways to reach clients

To increase your market share and keep your existing customers, you must find new ways to reach clients. These methods can include increasing referrals by maintaining customer relationships, using paid advertising, investing in social media campaigns, giving seasonal discounts, or even creating a blog.

Ideally, all your teams should work together to get new customers and bring in more revenue.

Invest in your human resources

Even with a world-class revenue growth strategy, your business will not achieve growth if you have uncooperative employees. It’s, therefore, essential to motivate your workforce and show them that you trust them.

Since teams are made up of individuals with different opinions, try and listen to their points of view and discuss which strategies would work. Finally, provide them with professional development opportunities.

If your employees are sufficiently motivated, they will be more willing to learn and adjust to new company strategies.

Invest in technology

Most companies, regardless of sector, have had a difficult time trying to catch up with technological trends in their fields. As business technology continues to evolve, companies that invest in new technology will always be one step ahead of the competition.

A typical business has email software, a word processor, a website, and social media accounts. Some businesses might also have internal chat software and customer relationship management systems.

Using the right technology can improve your company’s efficiency, cutting costs and increasing revenue in the process. Research the best all-inclusive systems you can use to speed up communication, automate your processes, and improve customer relationships.

How to get growth capital for a young business

It might take several years for a startup to mature and have consistent revenue growth. Before it gets to that stage, investment capital is often a challenge, and many close down before they can take off.

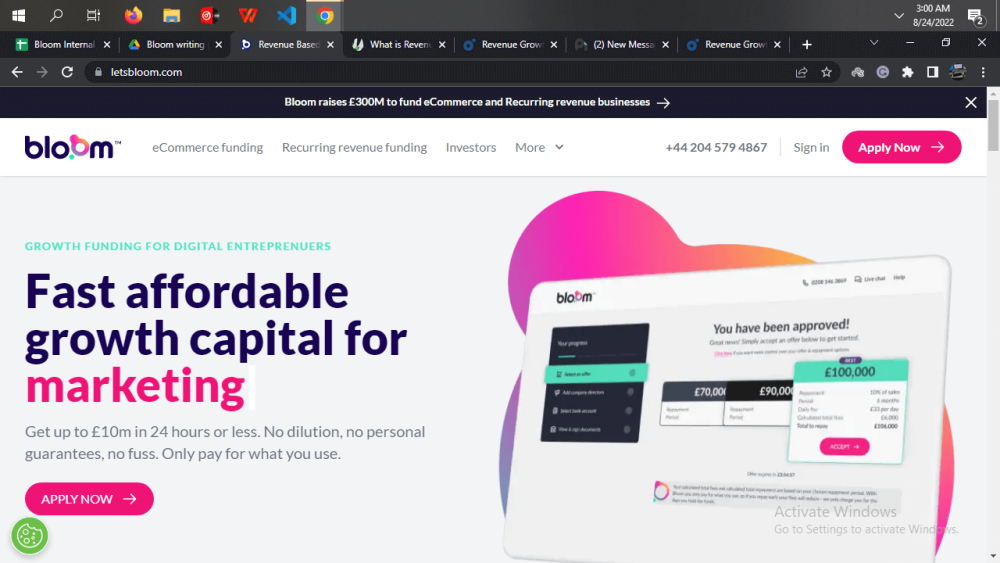

It’s, therefore, important to get reliable access to growth capital for a business in the startup and growth stages. Fortunately, Bloom offers fast and affordable growth capital for eCommerce stores and recurring revenue businesses.

How bloom works

Bloom funding is pretty straightforward to use. All you need to do is create a custom funding offer within 24 hours. You can then invest your funding in inventory, marketing, or sales.

You can also access more funding in the future if you need it.

Revenue growth FAQs

Still, have questions? We’ve got you. Here are some quick answers.

What is a good revenue growth rate?

Good revenue growth rate is quite subjective and depends on several factors. While growth rates above 10% are considered good, small growth rates of 2% and 3% can be healthy in some cases, especially for mature businesses.

However, most experienced investors recommend a year-over-year growth rate of above 15% for startups and growing businesses. This means that if you had a revenue of $50,000 in the first quarter of 2022, you should have a revenue of at least $57,500 in the first quarter of 2023.

What is a bad revenue growth rate?

The only revenue growth rate that can be considered ‘bad’ is a negative one. As long as you keep your growth rate positive, you will continue to experience an increase in sales.

That said, it’s important to note that the market does not like a declining growth rate. So you should try to keep increasing your growth rate period by period.

What is revenue CAGR?

Investors commonly use this term to refer to the revenue growth rate. It represents how quickly the business revenue has been growing for the past couple of years.

The revenue CAGR shows how the business has been increasing revenue, gaining marketing share, or the contrary.

Written by

Sam founded his first startup back in 2010 and has since been building startups in the Content Marketing, SEO, eCommerce and SaaS verticals. Sam is a generalist with deep knowledge of lead generation and scaling acquisition and sales.