Last updated: September 27, 2022

Software-as-a-Service (SaaS) is a business model that has grown rapidly in the tech world and is a popular way for startups to effectively bring new products to market and grow. There are many core metrics put forward for use in measuring the growth performance of a SaaS-based business. Revenue analysis is crucial to know how well your business is performing from a planning perspective and will be relevant information for existing and potential investors.

ACV meaning Annual Contract Value, and ARR meaning Annual Recurring Revenue are two terms you will undoubtedly hear if you’re involved in SaaS. They are similar in some ways but have quite different use cases for SaaS business owners. This article will detail these two metrics so that you will have a better understanding of available revenue analytics.

Table of contents

- What is the SaaS business model?

- ACV vs ARR: What’s the difference?

- Who uses ACV and ARR?

- How to calculate ACV and ARR

- Other SaaS metrics

- Final thoughts

What is the SaaS business model?

If you are considering offering SaaS to your customers, then you will essentially be providing a subscription-based solution where you retain ownership of the software and control over updates and maintenance. According to research by ResearchAndMarkets.com, the global SaaS market is expected to grow from $212.20 billion in 2021 to $240.61 billion in 2022 at a compound annual growth rate (CAGR) of 13.4%. The market is expected to reach $374.48 billion in 2026 at a CAGR of 11.7%.

With SaaS, your users connect to and use cloud-based apps over the Internet. Some examples of solutions in this category are those for email, calendar scheduling, project management, and collaboration tools provided by the likes of Dropbox, Slack, and Calendly. The software may be licensed for subscriptions on a monthly pay-as-you-go basis or annually.

Knowing how much each contract is worth per year and how much recurring revenue you’re generating are key metrics for measuring your company’s performance and growth potential. These metrics can help you plan your sales and marketing strategy and help you build the case when you are pitching for further investment as a subscription model business.

ACV vs ARR: What’s the difference?

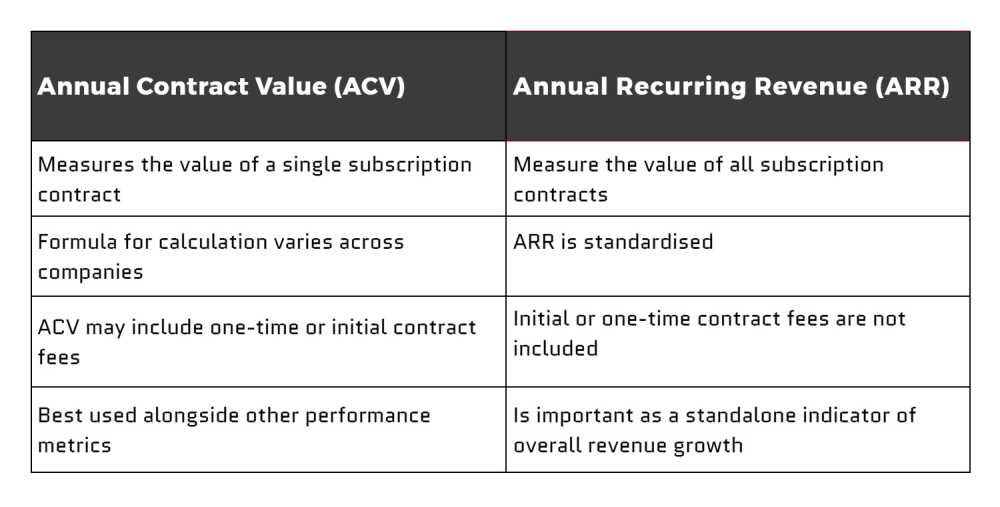

Though Annual Contract Value (ACV) and Annual Recurring Revenue (ARR) both measure revenue on an annual basis, they tell us slightly different things about the performance and growth of a business. ACV is a revenue metric that describes the amount of revenue you receive from a given customer each year using total contract value and is useful for measuring the success of your marketing and sales efforts. While ARR describes the amount of recurring revenue you can expect to receive from your existing clients in a given year and is essential for forecasting and predicting growth.

ACV definition

Basically, Annual Contract Value is a sales metric that enables you to track the value of individual customer contracts over a year. It’s the average annual amount a contract is worth (normally excluding any one-time fees or purchases).

ACV accounts for monthly contracts, annual subscriptions, and consulting services and includes the yearly value of a multi-year contract. It is the average value an ongoing customer brings to a business in a year. This metric is mainly used by SaaS businesses operating on an annual or multi-year subscription basis. It’s important to note that the ACV is calculated and is not totally standardised. For instance, some companies will include one-off set-up payments, and others won’t.

ARR definition

Annual Recurring Revenue is a SaaS metric that shows the money that comes in every year for the life of a subscription (or contract). It’s a good measurement of the health of a subscription business because it tells you the expected revenue amount, which helps with growth predictions. To calculate ARR, you will need to look at your subscription model's total revenue and consider where revenue is being reduced by customers leaving and changing the way they use your software.

You find out a more detailed breakdown of Annual Recurring Revenue in SaaS here.

How are ACV and ARR used in SaaS companies?

While the value of an annual contract is not often used to measure growth, it’s an effective way to measure customer success on a case-by-case basis. You can use ACV to help define your business model, inform on your sales strategy, and evaluate the value of your existing customers.

Ideally, you want to see a high and increasing ACV that indicates that your sales and marketing team are acquiring and retaining customers and growing monthly subscriptions, adding to your bottom line as a subscription business. It’s also a great way to contrast and compare the relative value of different types of customers who are using your products. This can inform where you focus resources based on target customer type, geo-location, size and a host of other variables that you want to focus on.

When you calculate Annual Recurring Revenue alongside a metric like CAC (customer acquisition cost), you can compare account values against the cost to acquire them and reevaluate your strategies, spending, and resources. As ARR is considered a measure of company size, it’s a great way for your marketing team to keep an eye on competitors and track your relative growth.

The importance of knowing ACV in sales

You can measure sales reps’ performance using the ACV of accounts they have brought onboard. This can help you address training needs and upskilling where required. Sales can also learn which clients to target with customer success strategies to retain high-value clients once those contracts approach their end date. This can help streamline your business process and show investors that you're on the right track to success.

With many early-stage companies having limited resources, knowing where to focus time and resources for maximum return is a major component of running an efficient SaaS company. Of course, every customer is important in business, but ACV sales calculations enable you to pinpoint exactly who is providing the most value to your company, so you can strategise ways to acquire similar accounts in the future.

Using ARR to attract new investment?

Annual Recurring Revenue is the metric you should go to while measuring the yearly growth of your company. This metric is less focused on individual cases since it’s the sum of all types of recurring revenue in a year. When this can consistently grow year on year, you’re in a powerful position to approach potential new investors to secure new investment and turn your company into a slick engine of growth.

ARR is an effective metric for making future predictions and investments because it provides information on how much revenue you’re expecting in a year or in multiple years. It can be used to validate your business model since ARR only takes into account revenue from subscriptions and not one-time purchases. Comparing the ARR of different years tells you about the success of your different marketing initiatives and can help you then make decisions that improve your marketing Return On Investment (ROI).

Who uses ACV and ARR?

Revenue metrics such as ACV and ARR are important to many stakeholders at SaaS or subscription businesses. Sales, marketing, and senior leadership at startups or established companies servicing B2B or B2C customers can use the information for defining sales strategy and understanding how much annual contract value and recurring revenue is expected. Some of the key job titles who you may share this information with include:

Customer success teams

Sales managers

Marketing leads

Product managers

C-suite executives - CEOs, CFOs, COOs

Customer success teams can use the revenue metrics to measure how well they are increasing customer value through retention, up-selling, and cross-selling.

Sales managers can use the information to look at key customer segments to target for acquisition and retention.

Marketing teams can use these indicators of revenue sources to decide where to focus segment-specific marketing campaigns.

The C-Suite and company founders or owners will use these measures of revenue and customer value to make longer-term strategic decisions, help form recruitment decisions and as a tool for attracting further inward investment, amongst other things. ARR is very relevant in measuring your company’s growth potential, and investors will be attracted to early-stage businesses that can show a year-on-year improvement in recurring revenue growth. Improving annual contract value has more limited use as a metric in this case and is better for informing on the effectiveness of your product offering and acquisition and retention strategies.

Which one should you use?

As already outlined, both metrics are important for you to know if you are operating a business in the SaaS space. Which one you should use depends on the individual circumstances of your business. Both metrics add transparency to overall revenue performance.

ACV is a more useful metric for sales and marketing to track. ARR is a powerful metric for measuring year-on-year revenue growth in subscription businesses. Where you are looking to build out targeting and segmentation strategies that are data-led, ACV can be of great help. Meanwhile, as ARR is a measurement of overall revenue growth, it is important when talking to potential and existing investors.

How to calculate ACV and ARR

There are also differences in what types of contracts you can measure using each of these two metrics. ARR is only effective when calculated with contracts lasting a year or longer. If a client agrees to an eight-month plan, you wouldn’t want to apply that revenue to your annual measurement, as that would produce an inaccurate tally. But ARR is a more accurate method for measuring yearly revenue, so it’s a great way to track revenue growth.

ACV is for a more granular look at the value of individual customer and customer segments to assess how well your post purchase activities, such as product marketing and customer success initiatives are maximising long-term value from customers.

How to calculate the ACV

There tends to be less universal consensus on how ACV is calculated compared to some other SaaS metrics. For example, some companies include one-time initial charges like setup or training in their ACV calculations, while others omit it.

The ACV equation is straightforward to calculate:

ACV = Total contract values / Total years in contract

Let’s assume that two customers subscribed to plans with your company:

Customer X chose a £600 per year plan for 2 years. One-time fee for this plan is £50.

Customer Y chose a £400 per year plan for 2 years. One-time fee for this plan is £70.

ACV for the first year = (£600 + £50 + £400 + £70)/2 = £560

ACV for the second year = (£600 + £400)/2 = £500

You can see here the effect of including the one-off fees to the first year calculation in upweighting the apparent value of the first year of the contract.

How to calculate the ARR

To calculate the Annual Recurring Revenue each customer pays you in a calendar year, most SaaS businesses include the sum of all new, upgraded, downgraded, and cancelled subscriptions.

The formula for calculating ARR is:

ARR = (overall subscription revenue + recurring revenue from add-ons or upgrades) - revenue lost from cancellations

The overall subscription revenue is the revenue you start the year with. For example, if your company uses a flat-rate pricing model with 15,000 users paying £50 a month, your total value per year would be £9m. Expansion revenue (from add-ons and upgrades) should only be included when it’s recurring. Cancellations or subscription downgrades make up revenue lost.

We can look at an example with three different customers with different subscription plans.

Customer A’s plan is £2,500/year for 1 year

Customer B’s plan is £1,500/year for 2 years

Customer C’s plan is £1,200/year for 3 years

In this scenario, ARR value will be:

Year 1 is £2,500 + £1,500 + £1,200 = £5,200

Year 2 is £1,500 + £1,200 = £2,700

Year 3 is = £1,200

To compare this with ACV all you would need to do is divide the sum of the ARR by the number of contracts or subscriptions.

Year 1 is (£2,500 + £1,500 + £1,200)/3 = £5,200/3 = £1733

Year 2 is (£1,500 + £1,200)/2 = £2,700/2 = £1,350

Year 3 is = £1,200/1 - £1,200

ACV vs ARR attributes comparison

Other SaaS metrics

TCV (Total Contract Value)

TCV is the total revenue you receive for a given customer contract and you need this to calculate ACV. It normally includes one-off fees and subscription revenue for the entire length of the contract.

The Total Contract Value formula is:

TCV = Monthly Recurring Revenue (MRR) x contract term length + any one-time fees.

Learn all about total contract value in our dedicated article.

AOV (Average Order Value)

AOV is another way to measure the average value of your revenue-generating subscription contracts. You calculate it by dividing ARR by the number of contracts.

Churn rate

This is a key metric for any SaaS company. It tells you the percentage of subscribers who are cancelling contracts. If you had 1,0000 last year and lost 500, your churn rate is 5%. Check out our guide to churn rate.

MRR

MRR measures the monthly recurring revenue a SaaS gets from subscriptions. You can read more about how it works on our blog about monthly recurring revenue.

CAC

CAC is the total amount it costs to acquire a new customer and is an important metric to measure against ACV. Read more about customer acquisition costs on our blog.

LTV

The lifetime value of a customer is a prediction of the aggregate contribution of an average customer to the company, generally during the lifetime of the customer.

Learn more about customer lifetime value

ARPU

Average Revenue Per User/Unit measures the overall revenue generated per user or unit. Total revenue of your business / the total number of customers you have in a given duration.

Final thoughts

Because SaaS companies vary so much in their business models, there are several ways you can approach using the metrics mentioned in this article to measure your performance and help build the case for speaking to investors. Revenue metrics are especially important in determining overall health and potential growth of an early stage company where obtaining investment can be more difficult because of perceived risk.

We’re experts in helping provide affordable non-dilutive finance to UK SMB and startup companies, you can contact us to discuss how we can help.

Written by

Sam founded his first startup back in 2010 and has since been building startups in the Content Marketing, SEO, eCommerce and SaaS verticals. Sam is a generalist with deep knowledge of lead generation and scaling acquisition and sales.