by Sam Franklin | August 04, 2022 | 10 min read

What is Landed Duty Paid in international trade?

Get fundedLast updated: September 02, 2022

If your business ships to international customers regularly or imports/exports goods, it will be essential for you to know the landed cost for each product to maximise profitability and optimise pricing.

Landed Duty Paid is all about knowing the exact costs for the entire shipping process of goods. It includes all the additional taxes and fees not charged by the seller, so you aren’t caught with wrong estimated costs leading to less profit.

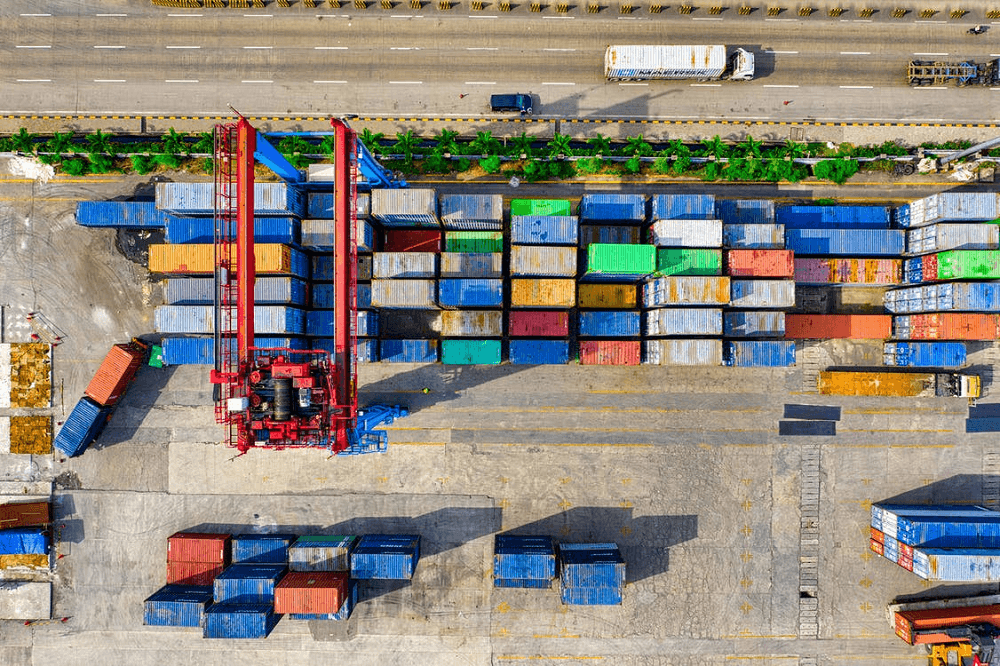

With so many handlers and carriers involved with transporting goods overseas in international trade, there are apparent costs and hidden costs.

Knowing the Landed Duty Paid allows business owners to develop a fully realised product cost. It helps to fix prices, reduce risk, and make shipping more convenient and cost-effective for customers.

This article will cover everything you need to know about Landed Duty Paid and Landed Costs.

Table of contents

- What does LDP stand for in shipping?

- What is landed cost?

- What is the difference between LDP and DDP?

- Advantages of LDP

- Disadvantages of LDP

- Conclusion

What does LDP stand for in shipping?

LDP is an abbreviation for Landed Duty Paid. It is a shipping term that quotes the final price a buyer pays for goods being imported across borders.

The landed price includes all the costs included in the supply line, from delivery and shipping to insurance, duty, and customs clearance. In a nutshell, the LDP consists of all expenses from getting goods from the supplier’s factory overseas directly to your doorstep.

The Landed Duty Paid (LDP) shipping fees vary for ocean, air, and land transport, and it also depends on how goods are imported - i.e. which Incoterms are used in the shipping.

It’s necessary for calculating landed cost as accurately as possible, so the sale price quoted to your customers is profitable for you. Therefore, it has a significant impact on your bottom line.

What is landed cost?

Landed cost is the sum of expenses associated with shipping a product from one location to another. It represents the total cost of a product from the seller’s factory right to the buyer’s doorstep.

The landed cost includes the initial cost of the goods combined with the cost of the shipment, insurance fees, customs duties, and any other charges that might appear along the way.

The landed cost is the most significant cost to consider, as the product's actual cost can eventually impact your bottom line profit.

For example, let’s say you purchased 1,000 belts from Indonesia for a total cost of $10,000 using the Ex Works (EXW) Incoterm. This is not your landed cost; you would be wrong to think that $10,000 is all you need to pay. Under EXW, the buyer (you) is responsible for handling shipping and clearing customs. Therefore, the landed cost must include the additional extra charges for shipping, taxes, and any other relevant costs associated with international shipping.

Why is it important to figure out Landed Duty Paid?

It is essential to figure out Landed Duty Paid to uncover all potential hidden costs that might arise when sending or receiving a shipment overseas.

Simply taking a deal that looks good on the surface might not be the best option to go for. For example, opting to pay for Delivered Duty Paid (DDP) shipping might look perfect for a buyer as they have limited responsibility. However, if there are hidden costs along the journey, such as demurrage fees, the buyer is responsible for paying, affecting their landed cost and overall profit.

Knowing the landed cost is essential to running your business efficiently. It will help you assess the performance of your operation and maximise your pricing structure. It is also crucial to figure out your landed cost as soon as possible because the earlier you know your landed cost as a small business owner, the earlier you know how to cover your expenses and make a profit to remain competitive.

If you estimate the landed cost too high, you might lose out on sales because you would charge higher pricing to your customers. On the other hand, if you estimate your landed cost too low, you could end up charging less for your products, and your profits could be negatively affected.

Finding the products' true cost can improve decision-making to get goods to customers in the most cost-efficient way. However, if your costs are even slightly miscalculated and you opt for an expensive shipping option, this could negatively impact your overall profit.

Furthermore, knowing the LDP also provides the opportunity to analyse the supply chain and determine where you can cut costs.

Most importantly, after you calculate your total landed cost, you will know if you can make a profit on your products and if your business model is sustainable in the long term.

How do you calculate landed cost?

Calculating landed costs can be difficult, and having the right tools available is essential to determine an accurate estimate. You should collect as many details about the shipping process from the seller and any other relevant charges that might arise along the way.

Most shippers don’t calculate the total landed cost because many factors contribute to the equation. These factors are challenging to obtain or estimate. Instead, sellers will quote you the freight cost, where they know all the charges relevant to their part of the international shipping process.

Many businesses use spreadsheets or internally developed tools to calculate their landed costs. These tools help to take out manual labour when doing the calculations and can log recurring costs. However, if you are just getting started, it will be best to log all costs until you have repeat business manually - then, you can move on to a spreadsheet or landed cost calculation software.

The first step in the landed cost calculation is to determine the individual variables contributing to landed cost.

What variables contribute to landed cost?

Several variables must be considered when calculating landed cost.

Cost of the goods

Obviously, the first variable that goes into landed cost is the purchase price of the goods. The commercial invoice should include the cost per unit for the overall shipment.

Shipping costs

The following variables to think about are all related to the cost of shipping. The shipping cost will depend on which Incoterms are being used in international shipping. Different Incoterms specify varying levels of responsibilities between the buyer and seller. The variation is wide with the buyer handling costs in EXW and the seller handling costs in DDP.

Variables included in the shipping category are the cost of freight, packaging, handling, loading, and port charges.

Customs costs

The next set of variables to consider for your Landed Costs are all of the costs that arise through customs. If you are buying products from a foreign seller, you will need to pay import fees (import duties) on your items. You must pay export fees (export duties) if you sell items overseas.

It is governments that charge customs duties and taxes on imported goods. The amount paid is usually a percentage of the costs of the goods, but it depends on the total value of the goods and where they are being imported from.

In the UK, the duty rates and taxes are paid to the UK Customs department. The amount of import duty depends on the value and type of imported goods. To calculate your duty, you will need to know which harmonised tariff system code (HS code) your goods are placed under.

Typically, if the goods are excise goods worth more than £135, you will be charged Customs Duty and will need to pay it on the price paid for the goods and the postage, packing, and insurance. The Customs Duty rates can vary from 2.5% upward, depending on the type of goods.

In addition to Customs Duty, you will also need to pay Value Added Tax (VAT). The VAT is charged at the VAT rate that applies to your goods - typically 20%.

Other customs costs to consider are:

Tariffs

Customs broker fees

Customs processing fees

Harbour fees

Export licence

Certain products will require an export licence, a special permit, or official authorisation, contributing to the landed cost. These requirements vary between countries, so it is important to research each shipment individually.

Risk related costs

Next are all the risk-related costs designed to mitigate risk for both buyers and sellers in global trade. These costs include the following:

Insurance

Compliance

Quality assurance

Storage fees

Expected or unexpected storage fees are also costs that contribute to the total landed cost formula. For example, if your shipment is delayed and remains inside a terminal or a port longer than its allotted time, you will experience demurrage fees.

Other overhead costs

There are a host of other overhead costs to consider, including:

Corporate income tax

Currency exchange rates

Freight forwarding fees

Landed Cost formula

When you know all of the potential expenses, you can more accurately estimate your Landed Costs using the following formula:

Shipping + Customs + Risk + Overhead + Storage = Landed Cost

What is the difference between LDP and DDP?

DDP stands for Delivered Duty Paid. It is an Incoterm that specifies that the seller is responsible for delivering the goods to the buyer and covers the shipping cost. In addition, the seller has to handle the relevant import formalities, such as clearance and paying duty.

Under DDP, the buyer has to pay unloading fees. On the other hand, if you are quoted LDP, all the fees are included in the final price.

Advantages of LDP

There are certain advantages of getting quoted LDP for both buyers and sellers.

For the sellers, quoting LDP gives them control of the cargo rights throughout the entire journey. The seller owns the rights for the goods right up until the goods are delivered to the buyer. If something changes along the way, the seller is still the owner of the goods and can keep hold of them to recoup any costs.

In addition, quoting LDP also provides the seller with an opportunity for profit growth. The profit of using LDP is more than that of FOB because the seller takes more responsibility. Therefore, they can quote higher prices and pocket the difference.

For buyers, receiving a quote in LDP aids them in saving on time, taxes, and responsibility.

Disadvantages of LDP

There are still some disadvantages to quoting LDP. In total, there are three main risks when shipping with LDP that are all attributed to the seller.

First, the seller is responsible for transport risks. In global trade, anything can go wrong along each individual step of the journey. Because the seller is wholly responsible for every step of the voyage, they must ensure their risk is covered and take out any necessary insurance policy.

In addition to this, the seller faces customs clearance risk on the imported goods. If the seller cannot clear the goods for import at customs, additional costs could be involved, which they will have to cover.

Lastly, the seller risks the buyer not paying for the goods. Typically, sales contracts would dictate when the payment is due. However, in most cases, buyers prefer to pay for the goods when they arrive at the point of delivery. Therefore, if the seller has taken out the shipment, but the buyer does not pay in the end, the seller will be left out of pocket.

Conclusion

Understanding Landed Costs is essential to the overall profitability and competitiveness. Landed Costs are the only costs you should consider when trying to price up your goods, as hidden costs can negatively impact your bottom line.

As Landed Costs are essential to your profits, ask your supplier to quote Landed Duty Paid so you know your goods' exact costs when they arrive.

Written by

Sam founded his first startup back in 2010 and has since been building startups in the Content Marketing, SEO, eCommerce and SaaS verticals. Sam is a generalist with deep knowledge of lead generation and scaling acquisition and sales.