Last updated: October 06, 2022

You've just realised you have a hot new eCommerce business in your hands, but you have no idea about eCommerce valuations. It's not easy to put a price tag on something that has taken so much time and effort to build. You want to make sure you get the best return on investment possible. Only 61% of business owners think about their company's worth, and the go-to resource to address this is a financial professional. As an entrepreneur, you can either overvalue or undervalue it, leading to a not-so-great operation.

Valuing can be tricky sometimes. That's why we've put together this comprehensive guide to help you go through the process using tried and tested methods. Whether you're looking to sell your eCommerce business or just curious about its health and growth potential, you'll be able to understand what factors influence the worth of an online business, including organic traffic, revenue, inventory, and other valuation drivers. Let's get into it.

Table of contents

- Step 1 – Reasons behind valuing an eCommerce business

- Step 2 – Know what factors impact the worth of an online shop

- Step 3 – Calculate the eCommerce value with the right method

- Get up to £10M in dilution-free capital

Step 1 – Reasons behind valuing an eCommerce business

Just as someone may know how to drive a car without necessarily understanding how an engine works, it's possible to value an eCommerce business without really knowing why you're doing it. Understanding the purpose of valuing a business helps to set the best course of action.

The 'why' is just as important as the 'how'.

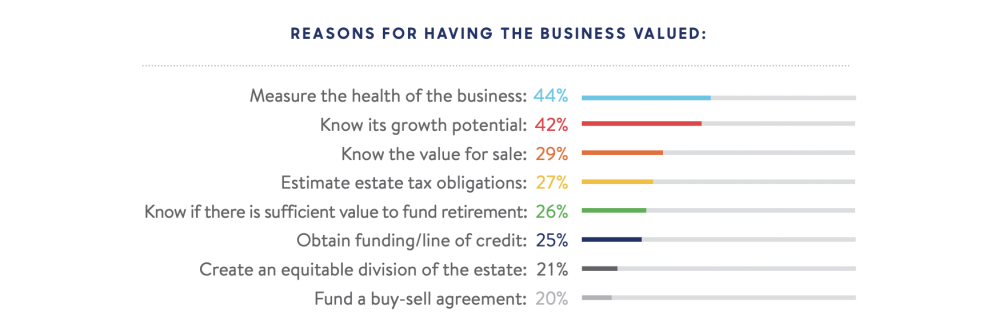

In a 2022 Business Owner Perspectives Study conducted by MassMutual, they found the following primary reasons why business owners value their companies.

Let's dive into each of them.

Measure the health of the eCommerce business

This can be done by checking financial stability, employee retention, and customer satisfaction. After all, a small eCommerce company growing rapidly and with a strong customer base is likely to be more valuable than a large company struggling to stay afloat.

Get a sense of the business growth potential

Industry, market size, organic website traffic, sales conversions, and the competitive landscape's strength can all affect a business's growth potential. There's no guarantee that a company will continue to grow at its current rate, but by taking a close look at the potential, you can get a better sense of what the eCommerce business is really worth.

Know the business sale value

You don't want to sell too low and leave money on the table, but you also don't want to overprice and turn away potential buyers. But even if you don't plan on selling, knowing the sale value figure is still helpful because it's a good benchmark for measuring performance and progress. A professional appraiser can give you an accurate assessment of your company's value.

Estimate estate tax obligations

Valuing your company for tax planning purposes allows you to make informed decisions about protecting assets, ensuring financial security, and structuring affairs to minimise taxes. All of this is to keep as much of your wealth as possible.

Check if there's sufficient value to fund retirement

Retirement is something that a couple of entrepreneurs face at a certain point. For some, it's sooner rather than later. And while there are different ways to fund retirement, one thing to consider is your eCommerce business’s value. Why? Here's a short list of cases:

Determine how much income you'll have in retirement. You'll likely land a higher income throughout retirement with a high business valuation.

Fund other retirement expenses, such as healthcare costs. If your company is worth a serious amount, then you'll have more money available to cover these typical costs.

Create a retirement nest egg. Having a lot of equity in your eCommerce business means you can use that equity to fund a retirement savings account.

Pay off debt before retirement. In case you have a mortgage or credit card type of debt, paying it off before retiring can free up more money for other things.

Give peace of mind in retirement. Knowing that you have a valuable asset to afford anything if needed translates into peace of mind and makes retirement more enjoyable.

Obtain funding capital/line of credit

All businesses need cash to operate. Money is constantly flowing out in the form of expenses like inventory, payroll, suppliers, etc. Even though a company may have money coming in to cover those costs and still make profits, sometimes you need extra cash flow. Or maybe you want to merge or acquire another business but need some acquisition financing. That's why a substantial source of funding is crucial. One way to obtain financing is through valuations.

This process assigns your company a pound (£) value based on factors like its tangible assets, liabilities, and earnings potential. Doing this allows you to get a picture of how much your business is worth to investors or financial institutions. This information can be used to secure loans or equity investments from third parties (venture capitalists, angel investors, etc.). In other words, valuing your eCommerce business could help you access capital to scale things up.

Create an equitable division of the estate

This is done to divide your assets fairly among all parties involved during a divorce. It might be difficult, particularly if you have children from different marriages or other family members with competing interests. However, figuring out the market value of your business as part of your estate lets you create a more equitable division of your assets that takes everyone's interests into account. This may avoid family conflicts and ensure that your company continues to thrive.

Fund a buy-sell agreement

A buy-sell agreement protects the business in the event of the death or disability of one of the owners. It ensures that the company can continue operating smoothly – even in the face of unexpected circumstances – and provide peace of mind for the remaining owners. Without a properly funded buy-sell agreement in place, the ownership of the business could be thrown into chaos, and its future could be exposed to potential risks.

Step 2 – Know what factors impact the worth of an online shop

Whatever the reason behind wanting a valuation, we need to know what drives value in this space, so buyers, sellers, or any other type of party involved can set a realistic and fair price. Here are the most important valuation drivers for eCommerce businesses.

Financials – What are the numbers saying?

Financials are always going to be a key factor when valuing anything. At the end of the day, an eCommerce business is just like any other business – it needs to make money to be valuable. So, when potential buyers are looking at your online shop, they're going to want to see solid and verifiable financial records. They'll also be looking at things like…

Concentration of revenue. Are you reliant on just a few customers, or does your customer base have good diversity? A high revenue concentration from a single source may be less valuable than those with a more diversified income stream.

Seasonality. As the name suggests, this refers to eCommerce businesses that have spikes in sales at certain times of year (such as sunglasses in summer) and lulls at other times. This helps show potential buyers that there's an actual demand for your products.

Chargebacks, returns, and refunds. Three elements that can quickly eat into your profit margins. eCommerce businesses with rates of chargebacks, returns, and refunds higher than 20% may be seen as way less desirable than those with lower rates.

If the numbers don't make much sense, then your eCommerce business's value will be lower. It's as simple as that. So make sure that your finances are in good shape.

Customer base and retention – Do people love your offering?

Shops with high customer retention rates tend to have a higher valuation multiple because they count on a steadier revenue stream. Furthermore, most eCommerce businesses with a large customer base can use economies of scale to reduce costs and be more profitable. Therefore, when conducting valuations, it's important to consider the size and loyalty of your customer base.

Now, depending on a business model, the nature of the offering, niche, audience, and average price tag of products, your eCommerce business may (or may not) rely more on customers returning again and again. For example, a t-shirt shop isn't comparable to a store selling musical instruments.

In order to maximise value, it's essential to have a group of regular buyers. A key metric in this space is customer lifetime value (CLV). This is a measure of the average amount of revenue that a customer will generate over the course of their relationship with a business.

Obviously, the higher the CLV, the more valuable each customer is.

Take note of the following ways to level up your customer retention:

Have specific fool-proof product description pages.

Sell higher-ticket items or upsell customers on complementary products.

Lengthen the customer relationship by providing outstanding customer service.

Offer live chats, chatbots, and support on social media channels.

Create loyalty/referral programs that encourage customers to stay with you.

Post comprehensive FAQs alongside a knowledge base.

Brand awareness – Is your business known or not that much?

Analysts will often look at the brand's presence, the size of the customer base, and the company's ability to generate repeat business. Simply put, brand awareness is the extent to which customers are familiar with your brand. A strong brand can bring in customers and keep them returning, ultimately driving up sales and profits. Conversely, a weak or unknown brand is less likely to attract customers and generate repeat business.

Both Domino's Pizza and Pizza Union are pizzerias, but that's pretty much where the similarities end. Domino's is clearly a world-renowned brand, while Pizza Union is a London-based chain – a really good one. So, leaving quality out of the equation, where Pizza Union is undoubtedly better, Domino's still has a much higher business valuation because of its brand.

Creating a memorable brand involves choosing the right name, logo, and identity and then effectively promoting your brand across multiple channels. Marketing efforts, public relations, and customer word-of-mouth also contribute to brand recognition. We know this can represent a challenge, but it's what you have to do to compete against bigger players.

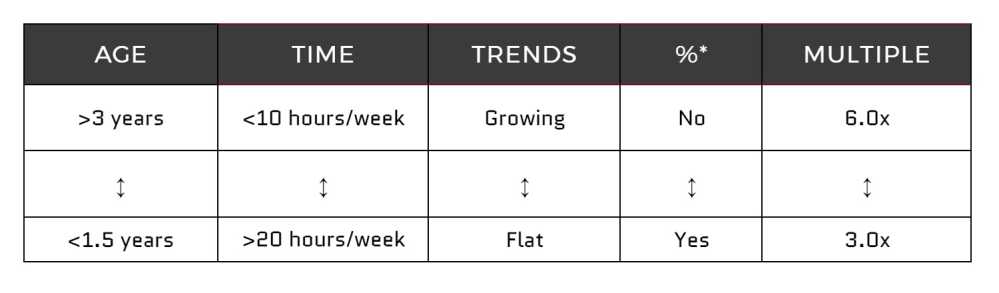

Age of business – How long is your track record?

Age is just a number, right? That may be true in some cases, but when it comes to a business's value, age definitely impacts an eCommerce valuation. Here's why.

More likely to be profitable. A mature business with a track record will be seen as more stable and, thus, more valuable. This history can help forecast future performance.

Less risky for potential buyers. This is because they know the company has already navigated the early bumps and growing pains common in the first years.

Customer loyalty. As your business ages, you're likely to develop a loyal customer base that keeps coming back for more. This repeat business can be precious.

Brand recognition. Over time, your business will build a reputation. This reputation can have a huge impact on your company's value. A strong, positive reputation pays more.

All these factors make an older eCommerce business worth more than a newer one. Of course, there are exceptions to the rule, but business age is generally an important consideration. The longer you've been in operation, the higher your valuation may be.

In a nutshell, less than one year is probably a NO, and at least three to five years is the way to go.

Traffic quality – Traffic with a gigantic bounce rate isn't good

Any eCommerce business owner knows that generating traffic is mandatory for growth. But not all traffic is created equal. Traffic quality is defined as visitors who are actually interested in your products and are likely to convert into customers – at least at some point in their customer journey. They may be visiting your site because they saw an ad or a piece of content relevant to their interests, or maybe because they were searching for a specific product you offer.

Based on the type of eCommerce site you manage, traffic volume is also important – but it's much less valuable if none of your visitors ever make it to your checkout page, especially if you're working with an eCommerce company. That wouldn't be the case for a newspaper or a magazine.

To start gaining traffic, you should ideally have a strategy in place and then invest in:

Search engine optimisation (SEO)

Content marketing

Pay-per-click (PPC) advertising

Online public relations

Check out the 21 Proven Ecommerce Marketing Strategies to Try in 2022 by Shopify.

Operations – Are they cost-effective enough?

Operations and operating expenses are significant valuation drivers. A well-run operation will be more efficient and have lower operating costs, increasing the business's worth. On the other hand, a company with poor operations will have higher operating costs and be less valuable.

The following are some key factors to consider:

Operation efficiency. How well does the operation run? Are there any bottlenecks or inefficiencies? Prevention is key to keeping these issues from arising in the first place.

Operating costs. What are the fixed and variable costs associated with running the operation? Are these costs reasonable? It will help if you break them down.

Operation scale. Is the operation large enough to support future growth? Could it lead to economies of scale? What would need to change to accommodate growth?

Owner involvement – Does the thing work without you?

Ask yourself how involved you are in the day-to-day operations of your business, and be honest about it. Are you able to step away for extended periods of time and still have the business run smoothly? Or are you the only one who knows how to keep things running?

If you're the latter, then it's likely that your business isn't as valuable as it could be. One of the key factors that investors pay attention to when evaluating an eCommerce business is the company's scalability. To put it in another way, can the business grow without the need for constant owner involvement? If the answer is no, then it'll be hard to sell for a good price.

This is because potential buyers will be looking for a business that can operate with a relatively hands-off approach. Less than 10–20 hours a week, to be more specific. For this reason, make sure that your eCommerce business can function without you before trying to sell it. Otherwise, you may find yourself having to accept a lower valuation than you would like.

Logistics and fulfilment – ShipBob, Zendbox, Amazon FBA?

This includes everything from how orders are processed and fulfilled to how they are shipped. A company that has well-oiled logistics and fulfilment can scale easily, and it can also provide a better customer experience. Instead, a lack of efficiency can lead to increased costs and frustrated customers, dragging down the company value – 85% of online shoppers say that a poor delivery experience would prevent them from ordering from that retailer again.

Third-party logistics and fulfilment services for eCommerce businesses include ShipBob, Zendbox, and Amazon FBA, to name a few. Each option has pros and cons, so make sure you do your research before choosing a suitable program. Browsing the Top Fulfilment Services in the United Kingdom is a good start.

Inventory management – Warehouse or dropshipping?

Deciding how to store and manage your inventory is one of the most important factors in running an eCommerce business. There are two main options for inventory management: warehouse storage or dropshipping. Both have pros and cons, and 'the best' option depends on your product offerings, shipping times, and operational budget.

Warehouse storage

Warehouse storage is the more traditional option for inventory management. In this model, eCommerce businesses purchase products from suppliers and store them in a central location. When customers place orders, the products are then shipped out from the warehouse.

Pros:

It gives you more control over your inventory management.

It ensures that products are properly stored and maintained.

You are able to track stock levels more easily to avoid oversold items.

Cons:

Renting or purchasing warehouse space is a considerable investment.

Additional expenses like hiring staff to manage inventory and fulfil orders may be necessary.

Dropshipping

Dropshipping is an option for inventory management that has become very popular in recent years. In this model, eCommerce businesses partner with suppliers who ship products directly to customers on their behalf. This eliminates the need for brands to maintain their own warehouses and stock levels, which can save on operational costs.

Pros:

Shorter shipping times since products are shipped directly from the supplier.

Broad product offering to appeal to more customers and potentially make more sales.

Flexible to test out new products, without making large inventory investments upfront.

Cons:

You aren't storing products, so you have less control over quality and fulfilment times.

Relying on unknown suppliers for shipping may sometimes be unreliable.

Supplier relationships – Are suppliers under agreements?

When analysing an eCommerce business, potential buyers will also want to know the strength of the relationships with suppliers. A strong supplier relationship can provide a reliable source of inventory, favourable terms, and even pricing support. What is also true is that a poor supplier relationship can lead to stock shortages, delayed shipments, and damaged goods.

Are the suppliers under contract? How long have the relationships been in place? What's the history of on-time deliveries and quality of products? By understanding supplier relationships, buyers can better understand the risks and opportunities associated with the business.

Trends and market outlook – How's the competition out there?

How is the competition doing? What are the latest industry trends? What is the general outlook for the sector? If the sector is growing rapidly or major trends are taking place, such as the move to mobile commerce, then these things will be reflected in the valuation.

Competition is another component. With a fragmented market full of numerous small players, this may be seen as an opportunity for eCommerce business growth, attracting new customers and driving sales.

Growth and scalability – Can the business make more money in the future?

If the answer is yes, then you're on the right track. Because what's the point of investing in a business if there's no potential to bring in more money down the road? Investors look for companies with a real direction for further expansion without requiring additional resources, which makes total sense from a financial standpoint. Business appraisers do the same. They want to see that you have something to increase revenue and amplify your customer base. If you can show that, the higher the revenue multiple will be.

Below is a list of indicators of eCommerce's growth and scalability:

Sales conversion rate

Average order value

Customer lifetime value

Customer acquisition costs

Shopping cart abandonment rate

Returning customer rate

Bounce rate

Click-through rate

Store sessions by traffic source

Top products by units sold

Month-end inventory snapshot

Average inventory sold per day

Platform technology – A non-technical person can run it?

Running an eCommerce is no easy feat. Another thing contributing to valuations is the technology platform the shop is built on. A user-friendly and easy-to-manage software makes a difference for non-technical peopleIt doesn't require an expert, extensive training or support. The names you already know, like Shopify, Magento, and WooCommerce, are great.

Legal – Is everything in compliance and legally okay?

One fundamental and often overlooked factor is legal. We're talking about everything from intellectual property to licences and permits. Having a strong legal foundation can protect your business from potential lawsuits and help you avoid costly fines. It can also give you an edge over your competitors, who may not have taken the time to properly protect their eCommerce businesses. Buyers will be simply willing to pay more for a legally sound business.

When considering the purchase of an eCommerce business, it'll require that the seller provide proof of legal ownership and that all escrow arrangements are sorted. This protects the buyer from any potential legal problems arising from the purchase and ensures that the transaction will be completed smoothly. Sites like escrow.com can help with this type of operation, but in transactions over £1M, a lawyer is recommended.

Step 3 – Calculate the eCommerce value with the right method

Similar to a SaaS valuation, the main methods are SDE and EBITDA. To calculate the value of your eCommerce business using these, you need to know the financials. Once you have those numbers, you can plug them into one of the formulas below to come up with either an EBITDA or SDE number.

Either of these two should be then multiplied by a revenue multiple, which is an estimate of how many times your earnings your business is worth. Everything's based on the valuation drivers discussed in Step 2 – Know what factors impact the worth of an online shop.

In the eCommerce universe, most multiples of revenue range from 3.0x to 6.0x, on average.

EBITDA

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortisation. In short, it's a measure of a company's profitability that strips out certain expenses. Depreciation and amortisation are non-cash expenses, which means they don't represent actual cash outflows. And interest and taxes can vary depending on the company's jurisdiction.

EBITDA = Net Earnings + Interests + Taxes + Depreciation + Amortisation

For instance, let's say a company has...

Net earnings: £5,000,000

Interests: +£500,000

Taxes: +£1,500,000

Depreciation: +£250,000

Amortisation: +£250,000

In that case, the EBITDA would be £7,500,000.

It doesn't include owner's compensation or one-time expenses and is better suited for eCommerce businesses that make over £2,000,000 annually. You'll have to use this EBITDA number to figure out your estimate with the valuation multiple agreed upon between all parties involved, i.e. you and the seller, broker, or investor. It's typically 3.0x–6.0x your EBITDA.

SDE

Seller's Discretionary Earnings (SDE) is a method that also takes into account interests, taxes, depreciation, amortisation, plus owner's salaries/wages, and any one-time expenses (e.g., app development). Essentially, it paints a picture of what the business would be worth.

SDE = Net Earnings + Interests + Taxes + Depreciation + Amortisation + Owner's Compensation

Imagine the following:

Net earnings: £1,000,000

Interests: +£100,000

Taxes: +£200,000

Depreciation: +£50,000

Amortisation: +£50,000

Owner's compensation: +£100,000

Your SDE here would be £1,500,000.

As you can see, this one includes the owner's salary, with the only difference being that it's mostly for smaller eCommerce companies earning less than £2,000,000 a year. Same scenario with the revenue multiple, it's 3.0x–6.0x your SDE number. Assuming in this example you and the other party involved land on a 4.0x multiple, the Seller's Discretionary Earnings of £1,500,000 would end up being a ~£6,000,000 valuation.

Get up to £10M in dilution-free capital

So you've built an online shop with a lot of momentum. You're ready to take it to the next level, but you have a few potential buyers lined up, and you want to make sure you get the most money possible or simply need some capital for growth. What's your business worth? How do you calculate that? The first step is understanding why online businesses are valued.

Once you understand the why behind an eCommerce valuation, it's time to analyse the valuation drivers and do the maths with either the SDE or EBITDA approaches so you can come up with a realistic estimate of what your business is worth. If you're looking for a more accurate valuation, consult with a professional appraiser or a mergers and acquisitions (M&A) advisor. At Bloom, we can help turn your momentum into dilution-free capital up to £10M.

Reach out today, and let us show you how easy it's to get started.

Written by

Sam founded his first startup back in 2010 and has since been building startups in the Content Marketing, SEO, eCommerce and SaaS verticals. Sam is a generalist with deep knowledge of lead generation and scaling acquisition and sales.