by James Hickson | July 12, 2022 | 10 min read

The eCommerce Business Owner’s Guide to Revenue-Based Financing

Get fundedLast updated: July 13, 2022

The world is experiencing an eCommerce explosion. In 2021, the value of the eCommerce market reached $26.7 trillion as online sales soared in a rapidly changing commercial environment, driven by changing consumer habits, new technology, and accelerated by the global pandemic that shuttered many high streets for months.

Table of contents

- What is revenue-based financing?

- Why revenue-based finance?

- How does revenue-based finance compare to traditional eCommerce finance options?

- When to use revenue-based financing?

- How to prepare your business for funding

What is revenue-based financing?

Revenue-based financing (sometimes called royalty financing or revenue-share financing) is a method of raising capital from investors who then receive a fixed percentage of a company's ongoing gross revenues until they're repaid. The amount of revenue you generate determines the length of the payback period. Simply put: the higher the revenue, the shorter the payback period, and alternatively, the slower the revenue, the longer the payback period.

What are the benefits of revenue-based financing?

Particularly for eCommerce businesses, revenue-based funding has some key advantages over other alternative finance.

Revenue-based funders look at cold hard facts

You won't be asked to sign any personal guarantees

You won't give up equity in your business

Funds are typically available within hours

Only pay back when your customers pay you

This is how different is a revenue-based model versus other funding options.

How does revenue-based financing work in practice?

We've made a good progress so far! Now it's time to take a look at an example to better understand how revenue-based financing works in practice.

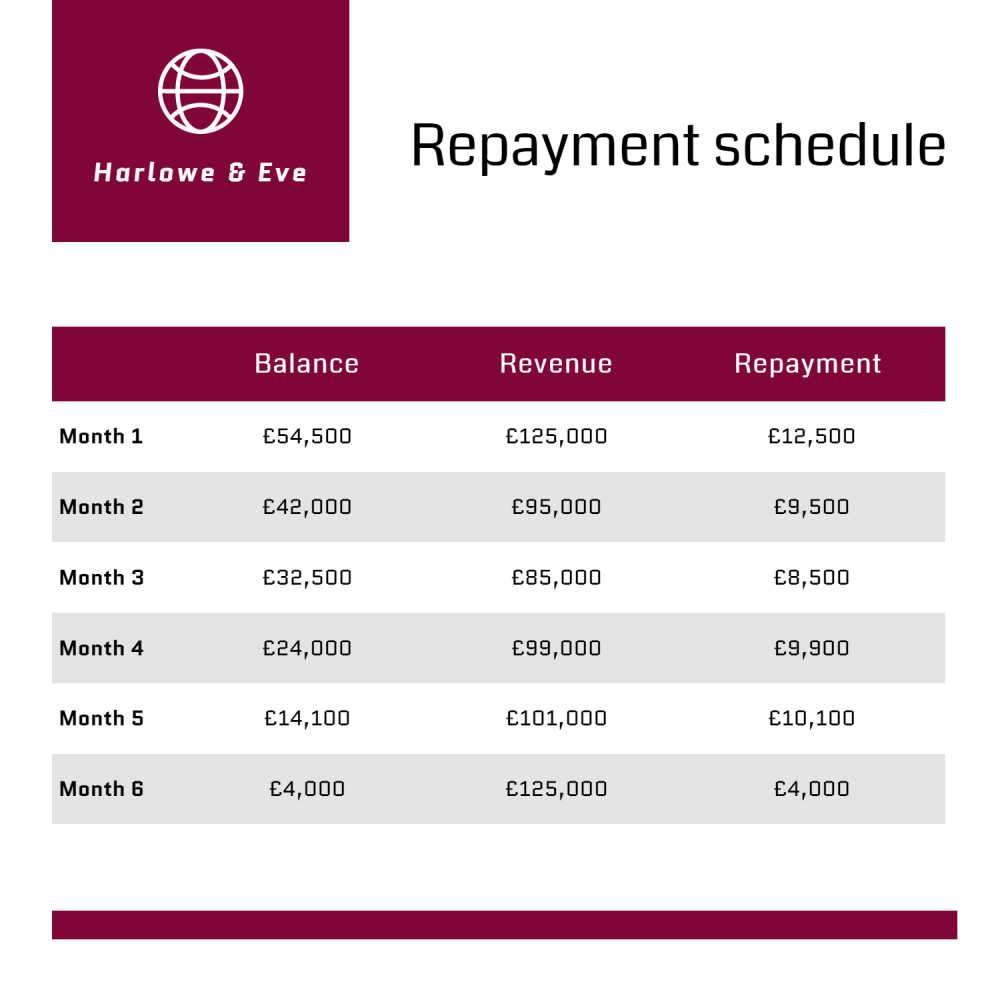

Meet Harlowe & Eve, a leisurewear retailer which has been up and running for a year. After a record month of eCommerce sales, they realise they have a good product-market fit. Their marketing strategy is working, but they need to increase their future sales and marketing efforts to take their business to the next level.

Step 1: Linking of back-end systems (Xero, Stripe, Bank)

So, Harlowe & Eve approach Bloom to explore revenue funding options. As part of the onboarding process, Harlowe & Eve connect their sales, marketing and bank account securely online. The more data they provide, the easier it is for Bloom to make a funding decision.

Step 2: Suggested selection of financing available offers

Having analysed the business performance, Bloom provides a number of investment options. As part of this process, Bloom ensures that the business can afford monthly repayments based on factors like average monthly revenue, current gross margin, etc.

Step 3: Pay-as-you-go and start growing

Harlowe & Eve decide to accept a £50K revenue-based investment with an expected duration of six months, a simple flat fee of 9%, and an agreed share of revenue of 10% until both the capital and the fee are repaid.

The eCommerce merchant continues the repayments until the capital and fee are repaid. Once they have repaid 60% of the investment, they can automatically top up their funds.

What can I use the eCommerce funding for?

There are a number of things you can use an eCommerce business loan for. Whether you're looking to expand your online business, or just cover the costs of some new inventory, eCommerce funding can boost your store. Of course, you'll need to prepare your business for funding in order to qualify for eCommerce business loans.

Some common reasons for needing extra capital include:

Inventory and new equipment

Hiring more staff

Refurbishing premises

Advertising and marketing

Short-term cash flow optimisation

Managing overheads and everyday operations

When it comes to looking for business finance to support your eCommerce sites, there's a range of eCommerce financing options, but not all are created equal.

Is revenue-based financing debt or equity?

Revenue-based financing, or RBF, is a type of debt financing. With RBF, a company receives debt financing in exchange for a fixed percentage of the company's revenue until the debt is repaid. This type of financing can be used by eCommerce businesses to obtain capital without giving up equity or ownership in their company.

Why revenue-based finance?

According to a CB Insights research conducted on 111 startups, they found that 29% of eCommerce stores that fail do so because they run out of cash. While this is a common issue for all SMEs, it's particularly hard in the fast-moving world of eCommerce given the fast-turning nature of products and the working capital cycle.

To stay afloat, every business requires agility, flexibility and innovation. And this is possible if there's access to capital so eCommerce businesses can absorb costs, adapt to changes in demand or manage inventory, marketing initiatives, and so on. That's where revenue-based finance comes in as a growing area of lending that is ideally suited to eCommerce entrepreneurs, balancing security, control and flexibility.

How does revenue-based finance compare to traditional eCommerce finance options?

Most traditional models of eCommerce business finance are based on debt or equity.

Raising debt, such as taking out a bank business loan, has the advantage of not giving away any of your business ownership, and you retain full control. However, debt comes with more risk to the company and business owner.

While you keep control, you also retain full responsibility for servicing the debt, which must be paid back by a fixed date, or you risk the loss of the business, or more if personal guarantees or collateral were given to support the business loan.

Equity finance, such as venture capital, doesn't need to be repaid and is a more flexible and less risky source of eCommerce finance. There are no repayments, and profits are shared between shareholders, but it also dilutes the ownership of the business. This decreases control in decision-making aspects of the start-up and reduces access to a segment of your future revenue as you share it with others.

That's why this revenue-based funding is a new type of eCommerce financing that is particularly attractive to direct-to-consumer and eCommerce brands that have traditionally struggled with the often outdated forms of financing in today's market.

Traditional alternatives for eCommerce financing

There are a few financing options available to you. Some of these include taking out a business loan from a bank, getting a merchant cash advance, government grants, or cash injection by a VCs or angel investors. Each of these business loans options has its own pros and cons, so it's fundamental to identify which one is appropiate for your eCommerce business.

Bootstrapping

Bootstrapping is an effective method of retaining 100% ownership, and therefore control, of your digital brand. MailChimp is a good example of what can happen when Bootstrapping is done right: the company sold for more than $12B, having raised no external capital in its 20 years of existence.

While there can be a certain sense of pride in following such a path, it's not without its dangers. Notably, there's a considerable risk that a small business will run out of cash if there are bumps in the road, e.g. revenues are lower than expected, there's a problem with a shipment, marketing expense increases unexpectedly, etc.

Bank finance

Despite being one of the fastest-growing business areas, online businesses can struggle to secure traditional eCommerce loan from lenders such as banks. It's not that banks don't want to lend working capital finance. It's that small business diversity and the ability to ingest real-time data create significant challenges.

Banks typically approve 8%-11% of small business funding applications. Often, these eCommerce business loans are underwritten manually using traditional methods. The cost of servicing for a smaller (potentially unsecured) business loan is comparatively high. And there's a lack of standardised business credit scores.

Plus, your local bank probably has access to data and analytics (e.g. to read your marketing or inventory data), and they will require collateral, which eCommerce businesses typically lack beyond stock, which by its nature is fast-turning.

As a result, bank financing may be frustrating for digital brands given:

The requirement for collateral

A time-consuming offline process

Non-tailored credit assessment

Lack of product and cash flow fit

No established credit rating

In summary, traditional bank lending is very rarely the path of eCommerce brands.

Venture capital and angel investors

This has often been considered an option. However, given the maturity of the eCommerce business market, and the low barriers to entry, there are few investors willing to invest in this space, especially to fund inventory and marketing spending.

Moreover, other obstacles of venture capital and angel investing include:

A proven track record of performance

Expensive and dilutive for founders

Potential loss of company control

Dilutive funding to scale the business

New people to the decision-making process

Possibly more discriminatory

For example, women of colour CEOs receive less than 1% of VC each year.

Third-party suppliers

Many entrepreneurs have tried to secure credit facilities from their suppliers. On the whole, this is challenging when dealing with Eastern suppliers who expect part payment on order and the balance paid on shipment and final delivery. Clearly, suppliers will also not fund marketing spending once stock is onsite or present in a company's third-party logistics warehouse.

When to use revenue-based financing?

Revenue-based financing (RBF) is a tool businesses of all sizes use to raise capital. Unlike traditional loans, which must be repaid regardless of the business's performance, revenue-based financing is repaid based on a percentage of future sales.

This type of funding can be a valuable option for businesses growing quickly and needing flexible capital to fuel their expansion. In addition, because repayment is linked to sales, businesses can use revenue-based financing to smooth out cash flow fluctuations.

As a result, this type of funding can be an attractive option for businesses that have strong growth potential but may not qualify for traditional bank financing. If you're not sure whether RBF is right for your company, here are three key questions to ask yourself:

Do you need growth capital but don't want to give up equity?

Is your company generating consistent revenue growth?

Are you ok with making monthly payments based on a % of your revenue?

If you answered 'yes' to all three of these questions, then revenue-based financing could be a good option for your business. Before entering into a revenue-sharing agreement, consult with a Bloom advisor to make sure all your questions are discussed.

How to prepare your business for funding

With the majority of lenders, revenue-based funding works off a data-based analytics model looking at key metrics for your eCommerce business. In simple terms, if you're looking for revenue-based financing, you must be able to show an ability to generate revenue.

Revenue-based finance providers, such as Bloom, link to your eCommerce platform, open banking solution or digital marketing platform to provide an offer relevant to your situation. It's important to remember that the more data you can provide, the easier it is for a lender to make a credit decision.

Generally speaking, most revenue-based lenders look for:

At least 12 months of trading history

More than £10K a month of sales

An eCommerce-based business

Registered company in the UK

Being over 18 years old

Other important factors will be that the online business does not have any CCJs or other payment remarks and that the business has a sufficient gross margin, which for eCommerce businesses is usually above 30%.

Get an eCommerce business loan in 24 hours or less

Every type of business is different - and when it comes to eCommerce – speed, flexibility and risk management are key. That's why a revenue finance solution is an ideal tool for eCommerce entrepreneurs, especially when compared to the traditional lending process of debt or equity financing. Bloom is an expert in helping eCommerce small businesses achieve huge growth.

We've developed a simple way for businesses to secure up to £10M in 24 hours or less. It takes just a few clicks to apply, and there are no long forms to fill out. Decisions can be made in minutes, and you can get the funds as soon as the next business day.

To find out more about how our financing model can help your business, sign up for Bloom revenue-based finance, get a quote from our team, and get funded in minutes.

Written by

James Hickson is the CEO and Founder of Bloom Financial Group, the winner of numerous industry awards – most recently recognized as FinTech CEO of the year as well as Payment Service of the year by AI Global Media.

Bloom is a European Fintech company focused on small to medium business lending. With their proprietary technology, Bloom offers e-commerce and retail brands access to revenue based funding (between 25,000 EUR and 3M EUR).