Last updated: June 03, 2022

Knowledge is power. Cash flow is everything.

According to FSB, around 50,000 UK businesses fail each year due to a lack of cash flow.

To survive and flourish, an in-depth understanding of your cash flow is imperative.

Whilst your cash flow statements will tell you your current and historical cash positions, what if there was a way to predict your future cash positions? How could you use that information to run your finances better?

Enter cash flow forecasting.

Cash flow forecasting is an essential part of financial planning. If done accurately, it can allow you to prepare for potential cash shortages or plan for growth by testing the impacts of various growth strategies on your cash flow.

As an entrepreneur or founder, it’s likely that you don’t have an accounting background, so the idea of creating a cash flow forecast may seem like an overwhelming prospect.

No need to fret. The reality is that cash flow forecasting is logical and easy to grasp - it just takes time and organisation.

We’ve pulled together this comprehensive guide to cash flow forecasting to tell you all you need to know.

Table of contents

- Prepare for future cash shortages

- Better manage your cash surplus

- Test various hypothetical scenarios and growth strategies

- Track business performance & overspending

- Monitor late-paying clients

- A forecast is a rough estimate made on assumptions

- Accuracy is time sensitive

- Tunnel vision

- Step 1: Decide the forecasting period

- Step 2: List your income

- Step 3: List your expenses

- Step 4: Enter your estimations into your cash flow forecast

- Step 5: Review and update your cash flow forecast

- Cash flow forecast example - start-up

- How to improve the accuracy of your cash flow forecasts

What is cash flow forecasting?

A cash flow forecast is a plan, based on estimates, of the money you can expect to receive and pay out within a specific time period.

It should cover your expected income and expenses across all areas of your company – for example, revenue from sales, operational expenses, money from grants and loans, one-off purchases, debt repayments, and so on.

A cash flow forecast can be done for the short, medium, and long terms - naturally, the longer you try to predict, the less accurate it will be.

Other factors such as how well established you are, and how much historical data you have, will also impact accuracy.

The importance of cash flow forecasting

It can be very hard to look much further ahead than the coming days or weeks due to the day-to-day demands of running a company.

The truth is, without a sound financial plan for the future, the chances of suffering serious cash flow issues down the line increase immensely.

Cash flow forecasts help you anticipate potential revenue shortfalls and surpluses by predicting when money will enter or leave your accounts.

In essence, a cash forecast is a financial roadmap for the months ahead, allowing you to optimise decision making for when to save, when to borrow, and when to spend.

Another key aspect of cash flow forecasting is the ability to avoid poor business growth strategy - a major SME cash flow killer.

Advantages of cash flow forecasting

Cash flow forecasting is an incredibly important tool for helping businesses. Let’s take a closer look at its benefits:

Prepare for future cash shortages

Predict which months might see a cash deficiency - whether that be from poor predicted sales, after a potential investment, or implementing a planned new product or service. Once you have an idea of which months may see limited or negative cash flow, you can begin to plan ahead and take precautionary measures to ensure you have enough cash to see you through.

Examples of such measures include:

Limiting spending for the month in question

Building a cash reserve (see below)

Not scheduling large purchases prior to or during the month

Considering using credit to pay suppliers

These measures can reduce outflow and maximise surplus cash to see you through the cash flow gap. Naturally, cash flow gaps are very common for seasonal businesses or after large investments.

To save a cash reserve, you should use your forecast to test worst-case cash flow scenarios, determining how long operations can be sustained in case of emergencies. In turn, you’ll know how much of a cash reserve you may need to save as a buffer.

Better manage your cash surplus

Cash flow forecasts also allow you to predict which months will see strong positive cash flow and plan how to effectively use this excess cash.

As mentioned previously, if you predict a few months of surplus followed by a couple of months of deficit - you’ll have an idea of how much surplus to save to see the business through.

Alternatively, you might predict a steady surplus for the entirety of your forecast - indicating an effective time to invest in growth.

Test various hypothetical scenarios and growth strategies

Before implementing new business strategies, test them through your forecasting model to see possible outcomes.

For example:

Before investing heavily in new production equipment or bigger premises.

Determining if you should hire new talent or a new member of staff.

Before offering new products or services, such as next day delivery.

Cash flow forecasts will quickly tell you if you have enough capital to implement these new strategies or how much you might need to borrow if there is a deficit.

Forecasting also promotes a disciplined process for deciding when to go ahead or when to reject a new idea - your business can recognise the levels of risk and reward before taking on new business ventures.

Track business performance & overspending

Compare your forecast to your cash flow statement month by month and identify the areas of business that are excelling or falling short.

You will soon build a clear picture of which areas you may be overspending on – is your projected cash outflow much less than actual outflow? Why?

Investigate and take measures to reduce costs in those areas.

An example of this could be that your cash inflow from sales might be consistently less than forecasted. After investigation, you find it’s due to your sales team giving out unnecessary discounts - you can now address this backed with hard facts, highlighting the importance of pricing.

By regular forecasting, you raise awareness within your business about cash flow and can confidently address underperforming or overspending areas.

Monitor late-paying clients

Outstanding receivables, aka late-paying clients, are a major cause of cash flow issues for businesses and also a major reason why your forecast might be falling short of its projections.

Your forecast will clearly highlight the issue of overdue payments, in turn allowing you to identify the late-paying clients.

Once identified, several solutions can be employed to encourage early payments – check out the common causes of cash flow issues and solutions guide for more information.

Cash forecasting limitations

As with anything in life, nothing is perfect, and the same goes for cash flow forecasts. There are limitations and drawbacks that you must make yourself aware of when predicting your future cash flow:

Unpredictable events outside of your control

Even with the most accurate data and research, you can’t predict major, unforeseen events that happen externally from your business.

These events could be anything from shifts in the marketplace, pandemics, emergency repairs and maintenance, rising costs, and the list goes on - cash forecasting simply cannot factor any of these issues and can lead to a false sense of security.

As mentioned earlier, if you don’t already have a cash buffer for emergencies, it’s a very wise idea to start building one. Adjust your outflow to allow for savings towards building a cash reserve.

A forecast is a rough estimate made on assumptions

Your forecast will be made from assumptions, including:

All of your clients pay within a certain period

The credit terms for making your own payments stay the same

Your client base remains or is predicted to grow, and so on.

If just one of these assumptions were to change, it can seriously affect accuracy.

Accuracy is time sensitive

Much like a UK weather forecast, the longer you try to predict, the less accurate it will be.

Making large financial decisions based on long term cash flow forecasts is not advisable. A better approach would be to bear the forecast in mind but also have contingency plans in place.

Tunnel vision

It’s important to not develop tunnel vision and develop an over reliance on your forecast assumptions.

On the one hand, it’s crucial for management to grasp the importance of cash flow forecasts - they need to understand that making financial decisions is based on optimal timing and the financial impacts that investments will have on future cash flow.

On the other hand, they must also know that the forecast is not set in stone and that blindly assuming the forecast to be correct can lead to improper financial decisions.

How to forecast cash flow in 5 steps

Forecasting is surprisingly simple. It’s a straightforward calculation of the cash you expect to bring in and the cash you expect to spend over the period you would like to plan for.

Basic cash flow forecast formula:

Cash flow forecast = beginning cash + projected inflows - projected outflows = ending cash

Beginning cash is how much cash your business has on hand today— you can take that number right off your current cash flow statement.

Projected inflows are the cash you expect to receive during the given time period. That includes current invoices and future invoices you expect to send and receive payment for.

Project outflows are the expenses and other payments you’ll make in the given period.

Let’s go into a little more detail by breaking down the forecasting process into five steps:

Step 1: Decide the forecasting period

Cash flow planning can range from a few weeks, a few months, to a few years ahead.

A well-established business with years of trading experience will have a more predictable long-term forecast due to years of sales and expense data.

A newer business will have less data to go from, so the forecast will be less predictable for the longer term. At this stage in your business’s life, it’s more useful to concentrate on the short to midterm.

Step 2: List your income

Income enters your business from two sources – sales income and non-sales income.

Sales income

Sales income is exactly that – cash inflow generated from sales.

Prepare a sales forecast based on your historical sales data for each month.If you’re a new business, you won’t have any historical records to benchmark from – start by estimating all your cash outflows.

Once you have your sales forecast, you use this alongside the credit terms you offer to your customers to forecast your cash receipts.

Cash receipts are critical as they show when the money is received into your business. To accurately forecast your cash receipts, you must rigorously investigate:

· When do your customers pay? Look at previous payment records and try to identify trends.

· Do you offer credit payments? What are the terms, and when are they paid?

· How long does the money take to transfer into your accounts?

· Your sales forecast will show income exclusive of VAT. Therefore your cash receipts should include VAT as this is the value your customers will be paying.

The more meticulous and exact you are, the more accurate your forecast will be.

Non-sales income

Now work out how much income you receive from additional sources NOT generated from sales. Examples include loans, financing, interest, or any rent you might receive.

Regular, monthly non-sales income is easier to predict. However, you must consider any one-off receipts such as selling off assets, GST rebates and tax refunds, plus government and other grants.

Again, be very exact when determining when the money will actually show on your bank statement.

Step 3: List your expenses

Like listing your income, you must divide your costs into direct costs from operations and indirect costs. Reviewing your bank statements will help you identify and forecast these payments.

Direct expenses

Direct costs associated with producing goods or providing services include:

Materials

Employee’s wages

Packaging

Advertising

Indirect expenses

Many of your indirect expenses will be paid monthly, such as:

Rent

Utilities

Travel costs

Phone bills

Investing surplus cash

Loan repayments

Buying new assets

*Remember to predict and include any incidental expenses.

Step 4: Enter your estimations into your cash flow forecast

Start with your opening bank balance – this is your actual cash on hand. Then add all the cash inflows and deduct the cash outflows for each period.

The number at the end of each period is referred to as the closing cash balance - this will be the opening cash balance for the next period.

Once you have your running cash flow forecast, it’s time to start planning your strategy - if you have a predicted low or negative cash flow for a month or two, you need to determine why and plan a strategy to see you through those months to make payments.

If you have months with strong predicted positive cash flow, you can start planning the best course of action for that surplus – investment, growth, saving a cash buffer, etc.

To test the impact of potential investments on your cash flow, enter the predicted investment costs into your forecast.

Next, add the predicted additional revenue generated from the investment, be realistic about when you might see this revenue, and determine the knock-on effects on your cash flow.

Please check out our comprehensive cash flow forecast template - you can modify it to suit your business.

Step 5: Review and update your cash flow forecast

Once you have your running cash flow forecast it’s important to compare your forecasted cash flow to your actual cash flow to keep track of the differences. If your actual cash flow is falling short, you need to determine what’s eating your cash from your forecast and act accordingly.

It’s also time to start planning your strategy - if you have a predicted low or negative cash flow for a month or two, you need to plan a strategy to see you through those months to make payments.

Alternatively, if you have months with strong predicted positive cash flow, you can start planning the best course of action for that surplus – investment, growth, saving a cash buffer, etc.

Finally, it’s crucial to update your cash flow regularly. If you have a change in costs, unexpected inflow and outflow, or reduced sales - you need to update your forecast. That way, you can keep your projections accurate.

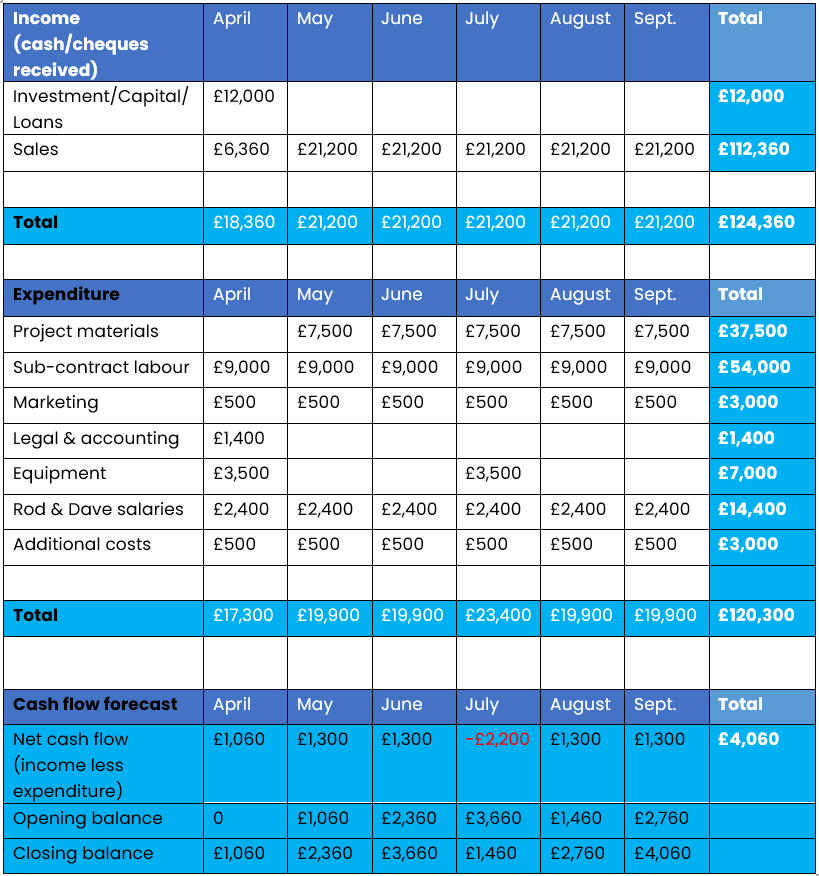

Cash flow forecast example - start-up

Here we’re going to run through a basic cash flow forecast example for a start-up.

Rodney and Dave are experienced landscape designers - they decide to partner and start a business together. They both invest £6,000 into the business.

Their product is a garden transformation service, where clients pay them to transform their gardens into luxurious, landscaped outdoor spaces.

Revenues:

Rodney and Dave are anticipating winning four projects per month for the next six months. Each project will generate £5300 of sales (£21,200 total per month).

Customers are expected to pay 30% of the fee as a deposit (30% of £21,200 = £6,360), with the remaining balance paid on completion. Each project is to last one month.

Costs for the start-up are:

Project materials: £1,875 per project (£7,500 per month). Suppliers will allow Rodney & Dave 30 days to pay their invoices.

Sub-contract labour: £9,000

Marketing: £500 per month

Legal & accounting costs: £1,400 (month 1)

Equipment: £3,500 in month 1 & £3,500 in month 4 - a total investment of £7,000.

Rodney & Dave will each pay themselves £1,200 per month during the establishment period of the business.

They have allowed for an extra £500 per month for additional expenses.

Add the assumed inflows and outflows to the cash flow forecast:

Key points:

Cash inflows

Note the one-off £12,000 investment, which is the money Rod and Dave put into the business.

In April, the sale of £6,360 is the 30% deposit from the four projects.

The total cash inflow is not the same as the total sales due to the £12,000 investment.

Cash outflows

Project materials don’t show in April due to the 30-day payment period offered by their suppliers.

There are significant additional outflows in April and July due to equipment purchases.

Net cash flow

Calculated by subtracting the total outflow for the month from the total inflow.

You can see that Rod and Dave’s business generates a positive cash flow for five of the six months. In July, there was a negative cash flow of -£2,200, reflecting equipment purchases.

Opening balance

This is the starting balance in the business bank account at the start of the period. If you are a start-up, this balance will be zero – as soon as investment funds are transferred, the cash flow begins.

The opening balance for the next month is the previous month's closing balance.

Closing balance

This is the amount left in the bank after all deductions – opening balance + net cash flow.

As you can see, Rod & Dave’s closing balance for April is £1,060, and the closing balance at the end of the period is £4,060.

How to improve the accuracy of your cash flow forecasts

Clearly set out your plans

Planning is everything. If you make decisions on an ad hoc basis, you risk severely impacting your cash flow forecast - make sure all your financial plans have been run through your forecast.

Regularly compare your forecasted predictions to your actual cash flow

Analyse the differences between your forecasted predictions and your actual cash flow on a regular basis.

Challenge yourself to understand the differences and question your estimations:

Which elements of your forecast are causing the differences?

Which areas of business overperformed or underperformed? Why?

Through regular analysis, your predictions will become more accurate over time.

Make sure you include ALL expenses

Large, one-off payments can have heavy, heavy impacts and are easy to forget when inputting your outflow - be sure to check, check, and check again when inputting your data.

Furthermore, people have a tendency to underestimate expenses. If you don’t already, implement a strict system for filing all expenses to ensure accurate data entry for future forecasts.

The bottom line

Although cash flow forecasting is not 100% accurate all of the time, it’s an essential tool to achieve a prosperous future for your business.

At the very least, the forecasting process will lead to more informed financial decisions, an understanding of how to avoid negative cash situations, and raise awareness of the importance of strategic forward planning.

Over time your forecasts will become more accurate, providing you with various routes to growth that have been tested through your cash flow forecast. You’ll know when to save, when to spend, and when to seek funding.

If you don’t already practice cash flow forecasting, we strongly urge you to make the time to do so.

Written by

Sam founded his first startup back in 2010 and has since been building startups in the Content Marketing, SEO, eCommerce and SaaS verticals. Sam is a generalist with deep knowledge of lead generation and scaling acquisition and sales.