by Sam Franklin | July 03, 2022 | 10 min read

The ultimate founder's guide to creating capitalisation tables

Get fundedLast updated: July 08, 2022

Any founder will likely tell you that their goal was to have full ownership of their business at some point. However, keeping that "full ownership" status becomes nearly impossible once you start expanding. One of the main reasons for this is financing.

For other businesses, it can be nearly impossible to start alone in the first place. That is where partners and the need to keep a proper record of ownership come into the picture. This ownership record and its usage variations are what a capitalisation table (cap table) is about.

This article will discuss what a capitalisation table is, what information it contains, and how you can use it.

Table of contents

- What is a cap table?

- Using cap tables for small business

- How do these businesses use cap tables?

- How do you make a capitalisation table?

- Cap table FAQ

What is a cap table?

A capitalisation table, also known as a cap table, is a table or spreadsheet that shows the company's equity ownership. It typically includes the amount of capital or funding obtained from each source, shared equity and long-term debt, and capitalisation ratios.

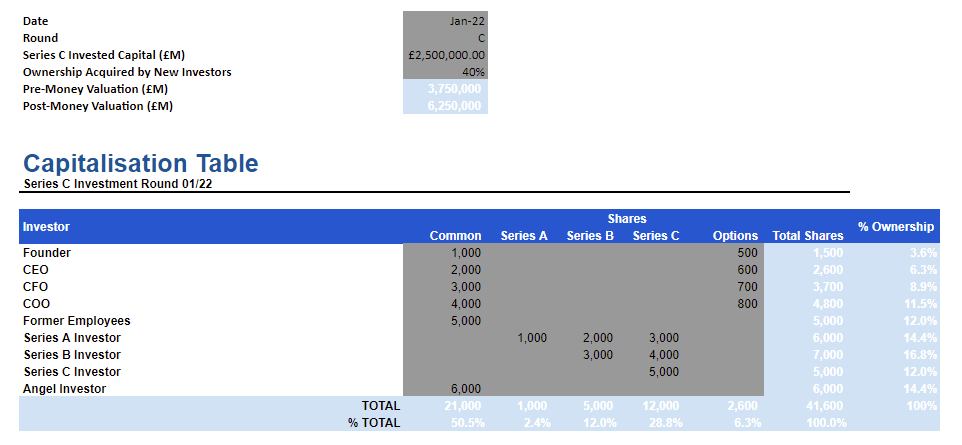

A sample:

The table defines the amount of capital that each partner has put into the start-up company and the corresponding percentage of company ownership they have. So, the values in the table change as new financing comes in.

For instance, if two original investors contributed £200,000 each, the total funding would be £400,000, with each business partner owning 50 per cent of the company. We would find these percentages and values in the capitalisation table.

Over time, the company might expand and attract new investments. So, for example, if the company has two new investors who invest an additional £200,000 each, then the total value will increase to £800,000, with each investor owning 25% of the company.

Clearly, a well-managed capitalisation table would attract higher investments and prevent dilution of your ownership stake.

What information does the cap table include?

A capitalisation table should have:

Shares information

A typical cap table breaks down the company's securities, also known as shares. You will find information about the common stock (ordinary shares), a company's primary form of capital stock. Ordinary shares are important here because they are usually entitled to economic rights, such as dividends.

List of investors

Cap tables usually provide a comprehensive list of company investors.

Pro tip

It is best to break this list down to the most granular level. For example, rather than mentioning that all the founders or investors have a 20% stake in the company, the capitalisation table should enumerate each shareholder's individual stake.

Shareholding details

The capitalisation table also mentions each stakeholder's type and the number of shares, as well as details about the kind of shares, such as preference shares, held by each stakeholder.

Valuation of shares

The shares of a start-up company are not usually publicly traded. So, their valuation isn't available daily. However, every transaction that impacts the valuation of shares should be updated in the capitalisation table.

As you can see, a capitalisation table organises and summarises everything you need to understand the company's key shareholders, share valuation, and distribution.

Using cap tables for small business

You need to create a capitalisation table before trying to raise business capital. Some key benefits of using the table would include:

Current shareholders and investors will want to know who has any control over the company to predict potential payouts

Current shareholders can easily determine what percentage of the company ownership to offer to new investors in exchange for their capital contribution

A well-prepared capitalisation table allows your team to present your start-up or company's history and holdings professionally and accurately for audits

Provide transparency into the financial records, especially for investors

The same applies to start-ups, which have a greater need to document their capital information. Remember that start-ups are more likely to require a greater amount of funding. They are also more prone to launching IPOs than regular small businesses. Therefore:

Start-ups need cap tables, too: here's why

A well-organised capitalisation table is a valuable tool for organisational management, legal preparation, stock management, etc. It requires you to consider multiple variables and thus allows start-up companies to track their ownership structure data.

Here are some reasons start-ups need capitalisation tables.

To attract investment

As a start-up, your business needs sufficient funding to launch operations, expand, and get past the start-up stage successfully.

But before investing in any company, investors want to become familiar with current shareholders, investors, and the equity interest of each investor. An updated cap table also helps potential investors decide the level of control they can exercise over the company during the preliminary negotiations.

Therefore, the transparency and information of a well-managed capitalisation table help avoid delays, increasing investor confidence, which is essential.

Save time and resources

A cap table saves you time and resources, especially in the long run. As your start-up company starts to seek funding, the capitalisation table will already be prepared and updated.

On the other hand, if your company has not kept records in a cap table, you will need to create one from scratch, which may increase the risk of errors as you may have lost important documents or financial records needed to develop and update the table.

Build trust

Employees also want to know more about the valuation of their company, such as the real-time value of their equity stakes or share options. A properly maintained cap table keeps employees informed and helps develop trust and confidence between various stakeholders.

How do these businesses use cap tables?

Decisions involving financing, restructuring, or sale of a start-up company tend to be complex and time-consuming, requiring several parties to sign off. So cap tables become a valuable resource for all parties. How?

To know the "power-holders"

Cap tables are used to record the equity ownership and composition within a company. So, studying a cap table can help investors determine which stakeholders they have to convince to obtain a sign-off.

Guides fundraising

When a company's management needs to raise funds, they refer to the capitalisation table to help the company measure the impact of raising funds through other securities, such as bonds and debentures.

So, companies can use the table to analyse the effect of the transaction on the company's debt-equity and financial leverage ratios.

To meet tax requirements and comply with other regulations

Sometimes, tax authorities refer to these tables when assessing or determining whether a company has paid what it owes in taxes. A capitalisation table is a formal and legal record of equity ownership in many countries, such as the UK and the US.

To consider the impacts of financial decisions

Cap tables also allow pre-IPO companies to see how different business decisions would impact the company's equity structure. For example, a shareholder can identify if they stand to gain or lose from an owner's financial decision.

If you are looking to create a capitalisation table for your business or start-up yet, here's how:

How do you make a capitalisation table?

There are two main ways to create a capitalisation table, and your choice depends on the resources and time available.

Manual method

You can create the table by maintaining a sheet in a Microsoft Excel file where you record the name of all shareholders and the type of securities they hold. Within the same spreadsheet, you can also maintain the records of securities that you issued at an earlier stage.

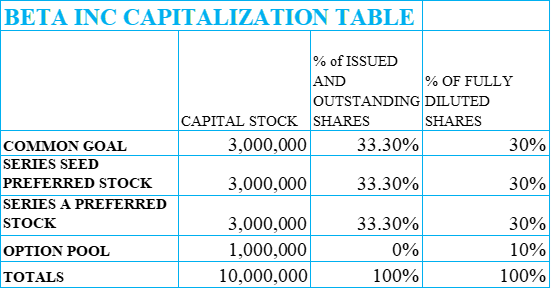

An Excel cap table:

With Microsoft Excel, you can build a capitalisation table from scratch. However, it isn't always a great long-term solution, even though it could be the least costly. The main benefit of building a cap table from scratch is that you can tailor it to your specifications.

Use a capitalisation table template

Alternatively, you can also use a capitalisation table template to create it. That way, you don't need to start from scratch. Instead, just customise it to match your company's figures, and you are good to go. Several sites offer easy-to-start templates that you can adopt today.

Cap table creation pro tip: keep the table as simple as possible and customise it to your corporate structure. Luckily, templates present a great way to do this.

Cap table template

Let's look at an example of a simple cap table.

This table represents a hypothetical breakdown of various securities, such as common stock, seed preferred stock, Series A preferred stock, and the available option pool. Simple and to the point!

Point to note: preparing a capitalisation table isn't a one-time activity. For start-up companies, employee stock options change, and the founders keep investing over time.

Company valuation may change from time to time. So, regular updates are necessary to enable accurate and quick decision-making.

Updating the cap table: how does it work?

Your company can also use a cap table to add current and future changes that might occur to the shareholder structure. Matters like issuing stock options, warrants, and convertible notes occasionally cause changes.

Pro tip: as your company grows, things can get more complicated, and it becomes tricky to know where the shareholding stands for each investor or partner. But you can reduce such complications if you use clear guidelines and update the table regularly.

Sample calculations to update your cap table

As a baseline, the equity ownership on a cap table totals 100%. As various events occur, such as new investments, the table must reflect the changes in the share numbers while maintaining the 100% total.

An example of changes with new investment:

A new investor X wants to provide £2million in exchange for 20% of the company.

Now, assume the company has 200,000 outstanding shares split 50/50 between the founder and another investor. How much do you think the new investor gets from their investment? Let's calculate that:

New owner’s stake = New shares / (Old shares + New shares)

To solve for new shares:

New shares = [Ownership stake / (1 - Ownership stake)] x Old shares

Based on our assumptions:

New Shares = [0.20/(1-0.20)] * 200,000 = 0.25*200,000 = 50,000

When compared to the company's original cap table, the new investor’s shares should represent 20% of the company. Therefore their percentage ownership will be represented as:

New shares added / New + Old shares = 20%

50,000 / (250,000) = 20% (percentage ownership of company)

Cap table FAQ

Are cap tables public information?

No, cap tables are not public information. There is no regulation or law mandating that private companies or start-ups disclose their capitalisation tables.

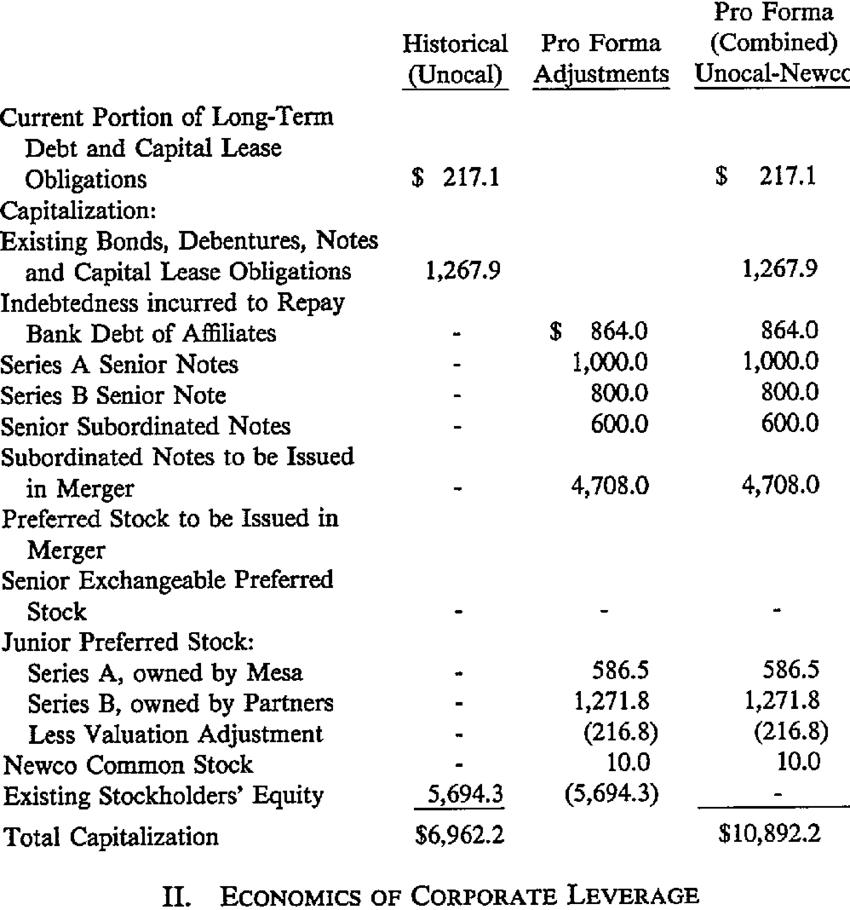

What is a pro-forma capitalisation table?

The parties often prepare a pro-forma capitalisation table during equity financing discussions and negotiations. It’s a spreadsheet that shows the capital structure of a start-up or early-stage business at present and following a potential investment.

This version of the capitalisation table shows the updated company ownership after closing a financing round.

Position your business for success

With your capitalisation table in the bag, your business is ready for the next level. You can now apply for funding with less stress.

While you can always pitch to private venture capitalists, you might want to consider other funding options like Bloom. We provide funding for your small business with no restrictions and zero equity demands! Reach out to us and find out more!

Written by

Sam founded his first startup back in 2010 and has since been building startups in the Content Marketing, SEO, eCommerce and SaaS verticals. Sam is a generalist with deep knowledge of lead generation and scaling acquisition and sales.