by Sam Franklin | September 01, 2022 | 12 min read

SaaS metrics 101 – Annual Recurring Revenue

Get fundedLast updated: October 06, 2022

When you're running a SaaS or subscription business, several key metrics must be tracked to ensure your company is healthy and growing. In this blog post from Bloom's SaaS Metrics 101 series, we'll discuss one of the most important metrics – annual recurring revenue (ARR). ARR measures how much revenue your company will generate in the next 12 months, assuming everything stays the same. It's an important metric to track because it can give you a snapshot of your company's health and growth potential. Stay tuned – it's time to learn everything you need to know about ARR, how to calculate it, and why it matters.

Table of contents

- What is annual recurring revenue (ARR)?

- How to calculate annual recurring revenue (ARR)

- Common ARR figures misinterpretations

- Optimising your annual recurring revenue (ARR)

- ARR Benchmarks – What is a good ARR for SaaS?

- Conclusion

- Annual recurring revenue FAQ

What is annual recurring revenue (ARR)?

Annual recurring revenue, or ARR, is a key metric used by subscription businesses to measure and predict future revenue. It's calculated by taking the total revenue from a given year and dividing it by the number of days in that calendar year. The term "recurring" refers to payments that are made regularly, yearly subscriptions in this case. ARR is basically MRR (monthly recurring revenue) but on an annualised basis.

Why does ARR matter?

Many businesses are shifting from traditional revenue methods to subscription-based models. Annual recurring revenue (ARR) is a valuation metric used to measure the success of a SaaS.

The importance of ARR lies in the fact that it:

Reveals how everything is working – the good and the bad

Your company's ARR is a good indicator of how well your subscription business is doing. It shows you what's working and what's not. If your ARR increases, more people are subscribing to your service because you're offering more value. But if the ARR is going down, you might be losing subscribers because something isn't selling well or a marketing campaign isn't converting. Looking at your ARR can give you an idea of where your business is headed.

Allows long-term roadmapping of the company

ARR provides the stability that subscription businesses need to plan for the future. It allows companies to forecast their cash flow and understand how much they can invest in new product feature releases and expansion initiatives. ARR also gives a clear picture of the growth trajectory, which is essential info for making sound strategic decisions about the company's direction.

Contextualises other SaaS metrics

Third, and most importantly, ARR contextualises other metrics. It gives meaning to measures like customer churn rate and lifetime value. Without it, these numbers would be just numbers, fluctuating a lot from month to month, but annual recurring revenue smooths out those fluctuations and tells a story about a company's growth and profitability.

Increases the chances of a higher valuation

Investors want to see SaaS companies with strong and predictable revenue and growth, and ARR is one way to measure that. Companies with high annual recurring revenue are typically valued at a multiple of ARR, so if you can increase your ARR, you're more likely to see a higher valuation for your subscription business when it eventually goes public or gets acquired.

Who should use the ARR model?

This ARR model is ideal for companies with customers who stay with them for at least one year. By projecting each customer's monthly charges out to 12 months, you can clearly see how much you can expect to bring in every year. It's also useful for SaaS or subscription businesses that offer monthly plans. Although customers have the option to cancel their subscriptions at any time, this model can still provide an estimation of potential earnings.

How to calculate annual recurring revenue (ARR)

There are two main ways to calculate annual recurring revenue, one if you charge your customers on yearly subscriptions and the other if you do so monthly. Check out both ARR calculation formulas.

#1 Annual ARR formula option

This path relies exclusively on annual subscriptions.

ARR = Contract value/Contract duration in years

For example, if you have a customer who signs a three-year service agreement for £3k, you just need to divide that figure by the number of years of the contract – which is three in this example – resulting in £1k as the annual recurring revenue. Or... ARR = £3,000/3 = £1,000.

"But I have more than one customer AND different contracts, so...?"

In that situation, let's say you have 600 customers right now.

300 are paying for a one-year plan of £1k

200 are paying for a two-year plan of £2k

100 are paying for a three-year plan of £3k

Once you've written down these data points, calculate the average.

Average number of customers: 200

Average contract duration in years: two

Average contract spending: £2k

Apply this formula: (Avg contract value / Avg contract duration) * Avg number of customers

It would look like this (£2,000 / 2) * 200 = £200k.

#2 Monthly ARR formula option

And this alternative approach to calculating ARR is based on monthly subscriptions only.

ARR = (Average monthly revenue per customer * Number of total customers) * 12

Here's an ARR calculation example. Assuming your SaaS has 600 customers and...

300 are paying for a basic plan of £100 per month.

200 are paying for a pro plan of £300 per month.

100 are paying for an enterprise plan of £500 per month.

The math would be as follows:

Average revenue per customer: £300

Total number of customers: 600

ARR = (£300 * 600) * 12 = £2.16M.

All this means that your monthly recurring revenue (MRR) is £180k, and your ARR is £2.16M.

What to include in annual recurring revenue

When it comes to annual recurring revenue (ARR), there are three main types of income that you must track in the sheets: recurring invoices, upgrade revenue, and downgrade revenue.

Recurring invoices. This item is probably the most obvious source of ARR – they're charges (recurring fees, subscriptions) that a customer agrees to pay regularly.

Upgrade revenue. It's the income generated when a customer pays for a higher-priced subscription or add-ons to literally upgrade their service or product.

Downgrade revenue. Last but not least, downgrade revenue – as the name suggests – is the opposite of an upgrade when a customer switches to a lower-value plan.

What NOT to include in annual recurring revenue

The annual recurring revenue (ARR) is closely watched by investors and analysts alike because it provides valuable insights into a business's health and growth prospects, which is why we can't stress the importance of being aware of what should (and should not) be included in the ARR calculation enough. Otherwise, you may end up with misleading results.

All of these should be excluded, as they can distort the metric accuracy:

One-time charges

Set-up fees

Non-recurring add-ons

Discounts or coupons

Any variable fees

Common ARR figures misinterpretations

Now it's time to explore some common ARR mistakes that many early-stage startup founders fall into when analysing this metric, so you can avoid inaccurate conclusions.

Confusing ARR with cash in the bank

While ARR is a measure of predictable revenue, it doesn't directly indicate the money a company has in the bank or will receive each year. Instead, ARR is a more holistic number of a company's health, based on the total value of all recurring revenue from a customer over a year, even if that total revenue is not collected upfront. Just because a business has a high ARR doesn't necessarily mean they're rolling in cash. For this reason, ARR is an important metric for investors to watch, but it shouldn't be confused with actual cash flow.

Seeing discounts as part of the metric

Discounts, deals, promos, and any variation of these should be excluded from ARR, as they're one-time adjustments that don't reflect the true value of your services. Including these special offers can be misleading, as it can artificially inflate the total revenue. The truth is that discounts should be treated as a separate line item on the financial statements. They aren't part of your recurring revenue and shouldn't be included in your ARR calculations.

Putting aside late payments

ARR must be calculated based on all payments received within a one-year period, regardless of whether they're made on time or not. This is because late payments are still payments that have been made, and as such, they should be included in the calculation. Failing to do so would result in a not-so-accurate representation of the SaaS financial numbers.

Optimising your annual recurring revenue (ARR)

As any startup founder knows, generating revenue is not only bringing in money—you need to ensure that you're optimising your revenue so it's sustainable in the long term. The key to increasing your annual recurring revenue (ARR) rate is to understand the factors that drive it:

Customer retention

Helpful product upgrades

Upselling to existing customers

Cross-selling to new markets

New customer acquisitions

Increase customer acquisition

There's no question that acquiring new customers is essential to growing your business. But not all customer acquisition strategies are created equal. To really optimise your annual recurring revenue, you need to focus on acquiring high-quality customers who are a good fit for your product or service. This means targeting your marketing efforts and identifying the channels that are most likely to reach your ideal customers. It also means investing in a sales team that can close deals and build relationships with key decision-makers.

You may also be interested in The Ultimate Guide to Customer Acquisition for 2022.

Expand revenue through upgrades

Upgrades can come in many forms, but the basic idea is to offer additional features or services that enhance what your customers are already using. For instance, you could offer a premium version of your service with more features or an annual subscription that includes access to exclusive content. Whatever form they take, upgrades give customers a reason to keep coming back—which means more recurring revenue.

Boost retention to grow the LTV

Customer churn is the silent killer of businesses. And it's a challenge that all companies face. The problem is that it's often hard to control and can have a domino effect on other business areas. That's why it's so important to focus on retention and do everything possible to boost LTV. One way to do so is by offering more value through new features, discounts, referral programs, and most importantly – and often overlooked – exceptional customer support and experience. Pretty much anything that would make them want to stick around for longer.

ARR Benchmarks – What is a good ARR for SaaS?

In the SaaS world, there's no magic number that all businesses should aim for. There are benchmarks that can give you a sense of what a good ARR looks like. Generally speaking, a good ARR for an early-stage subscription company is around $1M, while a mid-stage SaaS company should have an ARR of $5M or more. Of course, these are just rough guidelines.

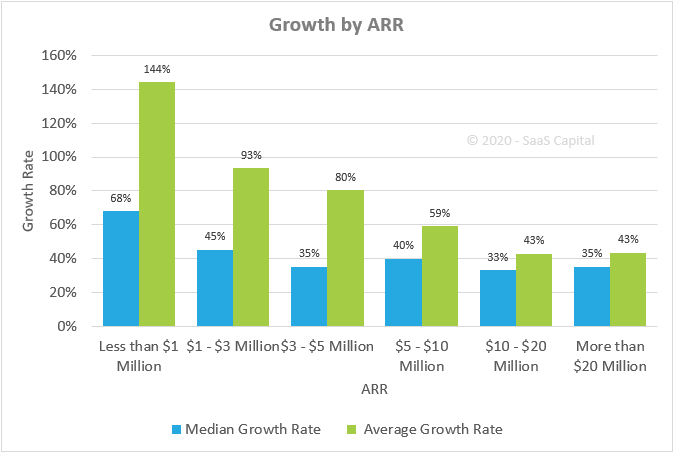

With the right team, product, and laser-like focus on customers, it's possible to make it, even in a crowded marketplace. According to a 2020 survey by SaaS Capital, the average growth rate for startups with less than $1M ARR is 144%. This number drops to under 60% for companies with more than $5M ARR, but even then, the growth is still significant.

There are successful SaaS companies with lower or higher ARRs. The important thing is to track your progress and ensure that your business is moving in the right direction.

Conclusion

The bottom line is that ARR should matter to every business, and it's especially important for SaaS businesses. If you want to know whether your company is healthy and stable or if you are looking for a new opportunity to focus on, start with your ARR. And if you need help getting there with up to £10M of Bloom's revenue-based growth capital, we're here to assist. Businesses can maximise their profits and ensure long-term success by clearly understanding how to calculate and optimise annual recurring revenue. Start tracking your ARR.

Annual recurring revenue FAQ

Is annual recurring revenue the same as revenue?

ARR is a measure of a company's recurring revenue over a one-year period. This means that it includes the total revenue a company expects to receive every year from recurring sources, such as subscriptions. On the other hand, revenue is a measure of all the money that a company brings in over a given period, regardless of whether or not it's recurring.

What is the difference between ARR and MRR?

Monthly recurring revenue (MRR) measures the revenue that a company can reliably expect to receive each month from its customers. This number is calculated by taking the total recurring revenue from a given month and dividing it by the number of active customers during that month. And ARR just annualises this figure by multiplying it by 12 (months).

What is committed annual recurring revenue?

Committed annual recurring revenue (CARR) measures the subscription-based revenue that a company has secured and locked in for the upcoming year. This metric somehow shows how much revenue is already 'committed' and can be counted on predictably each year. A high CARR figure means that the company's business is healthy and growing, as customers are actively renewing their subscriptions. Conversely, a low CARR figure may indicate that a company is struggling to retain customers and secure new subscriptions.

Written by

Sam founded his first startup back in 2010 and has since been building startups in the Content Marketing, SEO, eCommerce and SaaS verticals. Sam is a generalist with deep knowledge of lead generation and scaling acquisition and sales.