Last updated: September 12, 2022

Figuring out which shipping policy is best to import or export your goods can be a real headache. With thousands of freight forwarders and logistics companies, knowing who to trust and which policy to ship under can be difficult.

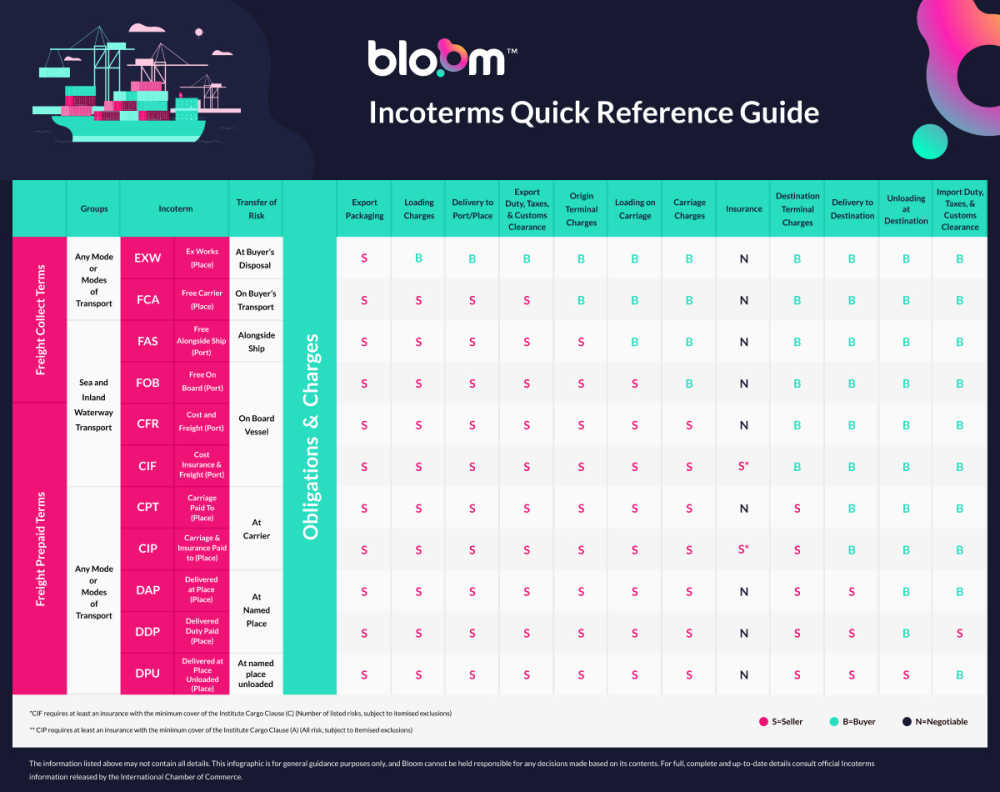

Fortunately, the International Chamber of Commerce (ICC) consolidated most shipping policies into eleven separate International Commercial Terms called Incoterms.

This article will cover everything you might need to know about the Delivered at Place (DAP) Incoterm and outline the shipping scenarios in which buyers and sellers should use it.

If you’re looking for information on the other Incoterms, see our Incoterms Overview section.

Table of contents

- What is Delivered at Place (DAP)?

- Understanding Delivered at Place (DAP)

- When to use DAP

- Advantages of DAP

- Disadvantages of DAP

- DAP vs other Incoterms

- Conclusion

What is Delivered at Place (DAP)?

Delivered at Place (DAP) is one of the eleven Incoterms created by the ICC. Under DAP, the seller is responsible and carries the full risk for delivering the goods until they reach the named destination that the buyer requests. This involves packaging the goods, transporting them to the origin port, arranging the main carriage to the destination port, and producing onward carriage to the named place requested by the buyer.

The seller is also responsible for handling any relevant export formalities such as customs duty and export licences.

Once the goods are made available to the buyer at the final destination, they are responsible for unloading the goods at the named place and handling all of the necessary import custom formalities.

The seller can only consider his duties complete once the goods have been unloaded at the named place.

Understanding Delivered at Place (DAP)

Delivered at Place was only recently introduced in the ICC’s eight publications of its Incoterms in 2010. In the eighth publication, the ICC replaced the previous DDU Incoterm, which stood for Delivered Duty Unpaid, and introduced DAP and Delivered at Terminal (DAT) to simplify the D-Terms group.

The DAP Incoterm can be used for any mode of transport, such as sea freight, air freight, road freight, and rail freight.

The Incoterm for DAP is highly flexible as the named place can be anywhere, such as a port, airport, seaport, or border crossing. However, the designated place for delivery is typically the buyer’s premises, but this must be communicated between the buyer and seller.

The seller is responsible for arranging the main carriage from their export destination all the way to the buyer’s import destination. The seller must also arrange onward carriage if the named place is not at the port in the buyer’s country.

The seller is not obligated to take out insurance under DAP.

Once the goods arrive at the named place, the buyer is responsible for unloading the goods and clearing them through customs. An agreed-upon time scale should be communicated to prevent delays and allow sufficient time for the goods to be cleared through customs as they arrive.

The pre-shipment inspection is important as it allows the buyer to know if there are any problems before it's too late.

What do Delivered at Place (DAP) shipping terms include?

The shipping terms for DAP include the time and place for the delivery to occur. It also breaks down the risk transfer between buyer and seller.

Following is a list of the standard terms seen in a DAT agreement:

Payment due to seller

Time and place of delivery

The precise unloading spot at the named place of destination

Seller’s responsibility

In the DAP Incoterm, the seller is responsible for the following:

Delivering goods safely at the agreed-upon date and point

Creating a sales contract and a commercial invoice

Export packaging and marking

Pre-carriage to terminal

Pre-shipment inspection

Arranging carriage for international shipment

Loading on carriage

Origin terminal charges

Destination terminal charges

Delivery to the named place

Providing notice to the buyer that goods have been delivered

Export formalities such as duty, taxes, and customs clearance

Buyer’s responsibility

In the DAP Incoterm, the buyer is responsible for the following:

Paying for the goods as dictated in the contract of sale

Providing the seller with relevant information required to fulfil obligations

Unloading at destination

Import duty and taxes

Import clearance at the destination terminal

Insurance

Where are the risk transfers in the DAP?

Under the DAP Incoterm, sellers are responsible for the risk of loss or damage to the goods right up to the moment they are made available at the destination place for the buyer to unload.

The risk transfer occurs as soon as the goods are available to the buyer, and the buyer takes on all responsibilities from then onward. Interestingly, the cost transfer and the risk transfer occur at the same point under the DAP Incoterm. This is because the cost transfer occurs as soon as the goods are about to be unloaded. From then on, the buyer is responsible for any costs associated with transporting the goods to the final destination if the named place is not the buyer’s warehouse.

When to use DAP

The DAP rule works well for transporting goods by land within the European and Asian continents. When no customs processes are involved between the country of origin and destination, such as within the European Union, DAP is better to use than DDP or another D-Term. In fact, it is one of the most popular Incoterms used for delivering goods within the European Union.

As the seller is responsible for the entire shipping process, it reduces the risk for new importers. However, they should be prepared to pay higher prices.

If the named place is the buyer’s warehouse, the buyer would only be paying for the goods once they arrive at their location. This means that the buyer only pays for the goods on the day they are received and is not tying up capital into inventory still being shipped.

In addition, the DAP Incoterm also provides some flexibility. For example, suppose a buyer has a regular relationship with a supplier for the routine reordering of goods. In that case, the seller can ship the goods to a bonded warehouse close to the buyer’s destination.

When the buyer is ready to reorder, the cargo can be sent from the local bonded warehouse instead of the supplier’s origin terminal. This allows the buyer to order lower quantities and have an efficient shipping process.

Lastly, DAP is recommended for containerised freight by the ICC.

Advantages of DAP

One of the main advantages to the buyer is that they have full knowledge of who is responsible for paying any additional expenses during the shipping process. Under the Incoterms, the buyer is only responsible for any costs associated with unloading. Therefore, any unexpected charges along the journey are held by the seller.

The buyer has minimal responsibilities during the shipping process, making their end of the deal relatively easy.

Disadvantages of DAP

The main disadvantages of using DAP typically lie with the seller as they have to arrange the entire shipping logistics to ensure that the goods are delivered to the named place for the buyer to unload.

As the buyer is responsible for clearing the goods for import, there could be a risk of demurrage charges if the goods aren’t unloaded in time. For example, this could occur if the goods haven’t been cleared for import by customs as they arrive at the named destination. In this case, the terms of sales should specify who is responsible for these costs.

There are also some disadvantages for the buyer to consider. For example, as the seller is responsible for the entire shipping process, the buyer will likely be paying a higher cost for the goods as the shipping costs are integrated into the sales price. On top of this, the seller is unlikely to have any reason to keep costs low for shipping, as they can easily be offloaded to the buyer.

DAP vs other Incoterms

The following is a quick comparison and summary of DAP against other popular Incoterms.

DAP vs DDP

Delivered Duty Paid (DDP) is one of the Incoterms that places maximum responsibility on the seller. DAP and DDP are very similar. The only difference is that under DDP, the seller is also responsible for handling all import formalities.

DAP vs CIF

TheCost, Insurance, and Freight (CIF) Incoterm specifies that the seller is responsible for delivering the goods and paying all shipping costs. The seller must also obtain insurance for the goods. In addition, under CIF, the buyer is responsible for paying the destination terminal handling charges (DTHC).

The difference between both Incoterms arises as the goods arrive at the port. Under CIF, the buyer is required to pay unloading fees at the import port. They are also required to load the goods onto the truck that is scheduled for the final destination. Under DAP, the seller handles these obligations.

DAP vs EXW

Ex Works (EXW) is the only Incoterm that places the maximum responsibility on the buyer. Under EXW, the buyer is obligated to handle the shipping logistics, including the import customs formalities in the seller’s country.

In comparison, the buyer is only responsible for handling the import formalities in their country and unloading the goods at the named destination in DAP.

Conclusion

Delivered at Place is an excellent Incoterm for buyers as the seller pays for most of the shipping process. However, the buyer must ensure that the goods are cleared for import on time to avoid additional transportation costs.

DAP is best used for trade between areas that require no import/export formalities in international trade, such as within the European Union.

Written by

Sam founded his first startup back in 2010 and has since been building startups in the Content Marketing, SEO, eCommerce and SaaS verticals. Sam is a generalist with deep knowledge of lead generation and scaling acquisition and sales.